A Company's Business Units

In theory, a company can be divided any way the board wishes, with each division assigned a management team, and having attributed to it certain revenues, costs, or assets.

Any division whose EP can be tracked can be called an "EP center."

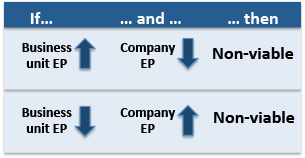

In reality, most business units are involved in significant exchanges of value with other parts of the company, e.g., goods or services, commitments of management time, etc. When those values are poorly tracked, or not tracked at all, by intra-company charges or transfer prices, it becomes possible for an EP center to pursue activities to improve its own EP that could hurt the EP of the whole company, and vice versa. The Casino Problem provides a classic illustration of this mismatch.

As a result of these exchanges, most possible ways of dividing a company would not yield "viable" EP centers. Most companies, in fact, have all kinds of intra-company value exchanges. Most of them are in the form of collateral costs or revenues, or shared costs incurred disproportionately by one unit.

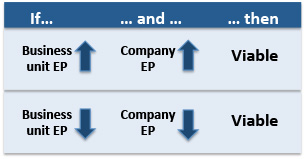

A "viable" EP center is designed to minimize the impact of collateral revenues or shared costs, i.e., to make it unlikely that we would experience material inconsistencies between how any given unit performs and the performance of the company as a whole. That is the same as saying that, for a viable EP center, the activities of its managers align reasonably well with their results, and their results align reasonable well with their activities.