Determining a Capital Charge

Including interest expense in Net Income creates two potential problems:

It combines operating and financing results, allowing changes in financial policy to induce changes in income. By isolating all financing costs in the capital charge, the measure becomes more useful at distinguishing operating versus financing sources of value creation.

- Interest expense represents the cost of debt at the time it was contracted. This may overstate or understate the current cost of that debt, depending on when it was raised, giving a distorted basis against which to compare current operating results. Current returns should be related to current capital costs.

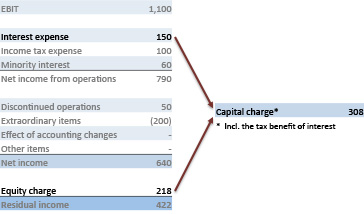

Here, we are proposing to combine the cost of debt and cost of equity into a single capital charge, being careful to make sure that the tax expense or benefits are associated as closely as possible to the costs. In this case, the tax benefit of the debt expense would be moved with the cost of debt from "above the line" of net income to "below the line" of capital charges.

In fact, we could calculate capital charges in any number of ways. Instead of calculating them based on the source of financing, as we are doing above, we could calculate them based on the risk of distinct asset classes, such a cost of working capital versus a higher cost of fixed net assets versus a yet higher cost for intangible assets. Different ways of determining costs of capital, and the number of capital sub-charges one might wish to implement, depends on the benefits and costs of doing so particular to your industry or firm.