Arriving at the Starting Point

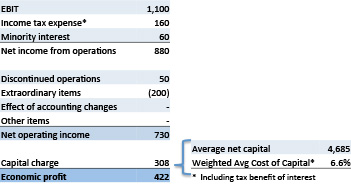

Thus, by distinguishing operating results from financing costs, with debt and equity placed 'below-the-line' in a capital charge, we arrive at Baseline EP:

Alternatively , if we begin with EBITDA, we just need to add a charge for capital.

![]()

Note that this capital charge is based on gross capital, which is to say gross assets. Since EBITDA does not include the depreciation or amortization costs of capital, that cost should be reflected in the capital charge.

These two formulations of Baseline EP, i.e., Net Operating Income less a charge for net capital, and EBITDA less a charge for gross capital, will end up with slightly differing period-by-period results, as seen here. But over time, the two variants of EP would discount to the same present value. In fact, all variants of EP, if consistently calculated to include all revenues, costs, and capital charges, would yield the same present value as a discounted cash flow valuation using the same assumptions. So, the choice about which way to calculate Baseline EP can be made from familiarity and convenience.