Posted by Marc Hodak on April 15, 2016 under Uncategorized |

Some of the happiest moments of my life were spent with Levend Beriker, my partner, my friend, my kindred spirit. Many of our moments come back like snapshots from another era:

- Standing at the railing of an outdoor bar after work, overlooking the Bosphorus, the lights from the Asian side dancing on its waters;

- Dining at a sidewalk table on the Upper West Side, talking about clients and kids and, in our single days, the women walking by;

- His smiling face as he walked toward me on a Mediterranean beach, announcing that he did a bungee jump that, just an hour earlier, he said would be nuts to even contemplate, and which he promptly talked me into;

- Having a beer with my parent’s on their Maryland deck when we were each visiting the D.C. area; my mom, a French-Moroccan Jew who maintained her home as a mini-U.N., loved that I had a Turkish partner, and such a fine one, at that.

It occurs to me that these particular snapshots are now twenty-year-old memories. In that period, we were single fathers of two young children (each) being raised on separate continents. Levend once suggested that we should rent a sailboat with crew and provisions for a five-day cruise with friends and family. I laughed that we could toast each other like Murphy and Ackroyd at the end of Trading Places: “Looking good!” It became our favorite toast whenever we celebrated new clients.

Then there is the snapshot memory of us meeting at the airport in Prague where we had decided, just days before, to converge and take in the sights. In one of those overpriced cafes on the Old Town Square, Levend told me he had met someone special. The impending denouement of his bachelor days no doubt prompted me to get more serious about the women I was meeting, or risk being left behind. So it is probably no coincidence that less than three months hence, I too would meet my future wife.

Next came his simple, gorgeous wedding in Victoria to Shannon, the love of his life. This memory seems more like a short film than a snapshot, me and my girl soaking in the Victorian charm of those magical days. A couple of years later, our reconstituted families were playing and dining together in Istanbul and in Kemer, the wooded community where Levend and Shannon lived.

And here is a literal snapshot of Levend, joining me and Stephan on a boat for an impromptu meeting on Lake Lucerne. I can’t recall the confluence of fortune that led us to this particular place. Levend seemed preternaturally prone to serendipity in his life, and, among his great gifts, taught me to embrace it in mine.

Levend and Shannon eventually moved to their little paradise in Victoria. With both of us in North America, we expected to see more of each other. But that didn’t happen. Levend’s transition from Turkey to the West Coast, and from our brand of client consulting to his new frontier of SAAS development, went a little slower than hoped, forcing him to divide his time between Canada and Turkey, making our personal (as well as business) interactions even scarcer.

After my wife and I bought our ranch in Texas, and began dividing our time between New York and Dallas, all my conversations with Levend were via phone and e-mail, always ending with “Let me know when you’re in New York” or “When are you coming to Victoria/Dallas?” For reasons best understood by working people who haven’t yet lost a best friend, we assumed that we would have a very long time to realize many such visits, even as the years slipped by.

One night last year, when Theresa and I were at a rooftop bar in New York, the surroundings inevitably had me thinking about Levend. So I dialed him up on FaceTime to tell him that I was missing him. I panned the phone across a scene of young professionals milling around with drinks, a scene that we had once so often inhabited. Levend nodded and smiled, then panned his phone to show an even more familiar sight–a plane full of passengers.

To the very end, I was actively working to get Levend meetings with Dallas banks to sell his new service, and of course to have an excuse for him to visit us at the ranch. I know he would have loved it, as we would have loved having him. We could have sat on our back porch beneath a big Texas sky, surrounded by woods, a small waterfall spilling into our pool, raising our glasses and saying “Looking good!”

I will miss him terribly.

Posted by Marc Hodak on January 16, 2015 under Uncategorized |

Having been buried in client commitments and research has required me to update our software to enable me to post more efficiently. With that behind us, I am ready to move forward with commentary on governance. I will continue to focus on compensation governance, but will also branch out in what I will be referring as “Level 3 research” and application of mechanism design theory to governance beyond public corporations.

Posted by Marc Hodak on February 8, 2011 under Uncategorized |

A coda on the Toyota scare:

A lengthy investigation by NASA into last year’s Toyota Motor Corp. recalls found that engine electronics played no role in incidents of sudden, unintended acceleration of its cars, U.S. officials said Tuesday.

The report, released by the Transportation Department to settle persistent questions over the Toyota recalls, concluded that the auto maker had identified the only two causes of the incidents: defective gas pedals and interfering floor mats.

I’m waiting now for the apologies from all those officials who jumped ahead with their public condemnations, and chased an honest company down the rabbit hole of congressional and media outrage, costing them (and ultimately all of us) billions of dollars.

Posted by Marc Hodak on October 5, 2009 under Uncategorized |

Two stories popped up today in an employment blog I follow:

EEOC Accuses Pro-family Group of Pregnancy Discrimination and EEOC Sues Vanguard for Racial Discrimination.

Every knows the costs of job discrimination. The people discriminated against have their hopes and dreams thwarted by arbitrary and unfair judgments. The owners or agents rendering these judgments remove their firms from pools of talent that might otherwise enhance their competitiveness. It’s a system fraught with pain and economic inefficiency.

The government has attempted to eliminate such discrimination using the tools that governments have–moralizing and punishment. Most governments are in no position to moralize, but that has never stopped politicians. Unfortunately, democratic governments tend to reflect, rather than confront, the prejudices of their people, so moralizing is rarely anywhere near as effective in ending economically inefficient practices as market processes themselves in punishing the firms that most irrationally discriminate.

Government penalties, however, are downright counterproductive. Once someone is placed in a legally “protected class,” whereby it becomes more difficult to fire them once hired, or where one must pay them regardless of their economic contribution, then the government makes these people more costly to hire. This is clearly true for pregnant women and minorities. In other words, the most enlightened businessman eager to hire the best, or even to bend over backward to hire someone from a disadvantaged background, is now penalized economically for doing so. They risk having to be stuck with redundant employees in a downturn where letting go of someone from a protected class creates an almost automatic liability. That may be one reason why minority unemployment is persistently higher than for whites, despite the overwhelming legal benefits to accepting and promoting qualified minorities.

Posted by Marc Hodak on September 17, 2009 under Uncategorized |

I don’t know who the couple dozen folks were who kept coming back to check my site for each of the last four days when they would get nothing more than a bare 404 notice, but thank you for your persistence. Hodak Value updated its main web site, and it temporarily screwed up this blog site. That is now resolved, and we push forward without further interruption, for which management is truly sorry and, as usual, the owner is even sorrier.

Posted by Marc Hodak on June 26, 2009 under Uncategorized |

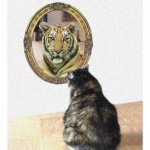

Hannah was a big, fluffy manx. She hated that. She hated that her appearance invited cuddling, as if she were some kind of plush doll. How demeaning.

“Don’t these humans understand? I’m a vicious beast. I have claws! And fangs! I could have them all for a snack, like that.”

Actually, Hannah didn’t have front claws, but she would sharpen them anyway against a door post or cardboard box when she saw me coming.

Hannah put up with us gamely. She would walk up to Tess and meow, and Tess would say, “Hi sweetie pie! Do you want hugs and kisses?” Hannah would furrow her furry brow as if to say, “How clueless are you, human? I’m shedding and I need brushing. Don’t pick me up…no…”

Hannah came in a package deal with Tess. For the first ten of her fifteen years, it was just the two girls. They were inseparable. Tess took Hannah on business trips; the kitty would greet her when she got back to her room. Tess thought Hannah was the most beautiful, intelligent, loving creature in the world. Hannah saw Tess as beautiful and loving, as well, but a little dense. Hannah would tell her what she wanted…food, brushing, scratching, etc… and Tess would ask, “What is it, sweetheart? Do you want hugs and kisses?” You could see Hannah’s reaction: “Oh, what a dear idiot.” She would then repeat her request more slowly, so her dopey mom could understand.

Of all the dim things her mom ever did, though, bringing me into their lives was the most inexplicable. “Don’t you understand, anything?” Hannah tried to warn her. “This big, ugly, stupid, hairless ape will ruin everything!” Hannah complained about me often. When Tess would return home, Hannah was always at the door to greet her, and tell her how I had tormented her with attention, or threats of attention, which for her was always unwanted, except for the chin scratching, and a little around the ear, when she indulged me.

Even worse, the Man that Tess latched onto had two boys, which besides all that unwanted attention meant a total of six big feet, lumbering around like a clueless field of swinging mallets. Since she normally operated in stealth mode to avoid petting, we did occasionally kick or step on her by accident. Her mom did the same thing, but Hannah assumed, as when any misfortune befell her, that is was somehow my fault.

Hannah met her end, as is common in old cats, with kidney failure. We treated her for months with hydration and medication which, from her vantage point was simply daily poking and having putrid liquids shoved down her throat. (Again, I was clearly to blame, even though her mom was often holding her.) On the second round of treatments for an infection, she finally said, “Enough.”

Hannah will be shipped to back to the farm in Missouri where she was born so her grandmother can bury her next to the family’s other favorite companions, Nick and Shorty.

I already miss the ornery little fluffball.

Posted by Marc Hodak on March 10, 2009 under Uncategorized |

Remember the withering criticism of retention awards for the Smith Barney brokers? You can get reminders here, here, here, …

The gist of the critiques was nothing so sophisticated as the need to actually retain people. It was more on the order of grunts about “greed,” “pay for failure,” and “taxpayer theft,” etc.

At the higher end of this discussion were comments like this:

Where the heck are they going to go, if no bonuses (excuse me, rewards) are paid? I am talking about the “great” talent of Wall St that created such a nice and once-in-a-lifetime crisis. OK, some will leave, whatever. Most won’t. We are in a deep recession and even such “great” talent may not find alternatives easy.

So, how big of a retention risk did Smith Barney really have? Well, this big. SB has lost hundreds of brokers, to UBS, Wachovia, Raymond James, Oppenheimer, etc.–539 financial advisors so far this year. The ones they lost included the best-performing, and relatively best rewarded people. Most of the ones who remain had gotten no retention awards. They will get used to that as they find themselves working for a government entity.

Posted by Marc Hodak on January 23, 2009 under Uncategorized |

One of Obama’s first policies on entering the White House was a freeze on all salaries above $100,000. WaPo estimates that this will save taxpayers about $443,000, which I suppose will help pay for the $825 billion spending package he is considering. But of course the president is not really doing this as a cost savings; he’s making a symbolic gesture, albeit one being paid by his staff. It’s designed to make the nation feel better that other people are suffering along with them. It’s also, no doubt, meant as an example for the greedy businessmen that populate our executive suites.

I don’t know if this is a good idea.

Ordinarily, freezing pay would create retention risk, i.e., it would cause some number of people to leave who might otherwise stay. Presumably, the people who are there now are the best people Obama could find to fill those positions at those salaries, so turnover of those people on the basis of pay makes it likely that they will be replaced by “next best” people. It doesn’t appear that any of the 120 staffers affected by Obama’s order are having second thoughts about joining the White House as a result of this freeze, at least not yet. And turnover would eventually happen at the White House even without a freeze–most of the top people working there are already sacrificing pay relative to what they could make in the private sector. But a freeze makes turnover more likely. So, freezing pay sends a message that Obama doesn’t really care to have the best people working for him.

A company normally loses a little bit of it effectiveness with higher turnover as a result of incrementally poorer business decisions by “next best” employees. That’s not true of every company, of course, but it’s true on average over a large number of competing firms. The White House, being a political entity, loses a little bit of political efficiency. Those who are a bit cynical of the value of government might not think this is a bad thing, but it might be.

It might be that the White House balances the wasteful tendency of the truly, monstrously wasteful arm of government–Congress. If Obama really wanted to control spending, he would have someone study the impact of a better run White House on overall government spending. He might conclude that saving taxpayer dollars actually suggests a raise for White House staffers, in order to get the best people able to check the impulses of Congress. I could be convinced.

Posted by Marc Hodak on February 16, 2008 under Uncategorized |

That is the question that inevitably comes up whenever a mass shooting occurs. These things occur so infrequently, however, and their perpetrators are often so indistinguishable from millions of people like them who never resort to violence that there may be no practical answer to “Why?”

Nevertheless, the need to know “Why?” is powerful. It creates a hunger for news about these incidents that springs, fundamentally, from the desire to control dangers around us. News services are only too happy to try to satisfy that hunger with saturation coverage, crowding everything else from our consciousness for a while.

The fact is, we don’t know why. All the coverage and analysis in the world won’t tell us why. One thing, however, seems likely: the coverage itself contributes to certain types of news-worthy violence, like school shootings. It may not be possible in a free society to subdue such coverage. The best we might be able to do is honestly acknowledge that we can’t help ourselves, and that our futile desire to know “Why?” prompts immense media coverage. An inherently sensationalist media will naturally try to satisfy that demand, even if it means prompting copycat violence. Politicians will always use these spectacular incidents, and the media access these events give them, to express outrage in front of the camera because, somehow, that is a necessary part of the story.

Unfortunately, we have honesty on neither level. Political entrepreneurs promise to make our world safer if we only give them more money and more power. The media continually rationalizes its over-coverage of these events as a social benefit.

But if the media didn’t alert its audiences to mass shootings, the public wouldn’t know how to look for and interpret the warning signs of a potential shooter, Newman said.

That’s a Princeton professor quoted by ABC News. I’m less concerned by patent fatuousness of the comment itself than I am by ABC News’s trying it out on what they must pray is a credulous audience.

Posted by Marc Hodak on May 10, 2007 under Uncategorized |

When I was tapped by a kind, but apparently desperate dean to teach corporate governance at NYU, I decided it was time to actually read up on it. I knew plenty about the financial and compensation aspects governance, but I figured there was some law involved, too, and went on a hunt for sources. I stumbled onto some papers by Stephen Bainbridge and never looked back.

Professor Bainbridge has just published a book on Sarbanes-Oxley. He says it’s aimed at the business person. I just ordered mine, so we’ll see. But as a business person who has read a number of his papers, I can assure you he’s a writer who cares about his audience. And at $12, it’s a lot cheaper than one of his corporate law texts.