Come here and get your discipline

Regulators are finally looking at unicorns–private companies grown to over $1B–and all they see are unbridled horses. SEC Chairwoman Mary Jo White is bothered:

White echoed the concerns of some industry insiders that these tech start-ups are missing out on the market discipline public companies receive by being accountable to the whims of public shareholder. (sic)

And on top of losing out on the whimsy, White adds:

For these companies to be successful, investors must be confident that they are being treated fairly and that companies are being transparent.

That these things were written without irony shows how unmoored our discussion of corporate governance has gotten from reality. Clearly, the poor investors of Uber, Airbnb, and Snapchat must be slapping their foreheads, saying “THAT’s why success has eluded us! We need more SEC oversight!”

I’m sure the good governance mafia (GGM) will accuse me of being tone deaf with regards to the benefits of greater SEC oversight of these giant, private firms. Clearly I don’t get that without an additional two thousand pages of rules, these companies would just do whatever they want, and their shareholders would suffer. Because cheating your shareholders is how you build great businesses.

Here is an alternative view, one I recently shared at a major economic forum:

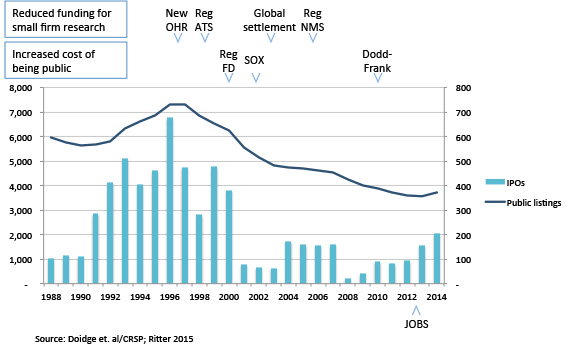

This chart shows some of the regulations that have multiplied the costs of being a public company over the last couple of decades. Yes, it’s possible that something other than these escalating public company costs led to the collapse of the IPO market. It’s possible that something other than these escalating public company costs have contributed to the dramatic decline in public companies. You have endogenous factors, omitted variables, and all that stuff. I understand.

But people who inhabit the executive suites, board rooms, and trading floors don’t need this chart to tell you what happened, especially those who grew up in the ’80s and ’90s when “going public” was the epitome of success. They will tell you that the costs of being public now outweigh the benefits for all but the largest firms. They know that a bad cost-benefit trade-off is not good for shareholders, regardless of what self-appointed “shareholder advocates” might say.

Admittedly, this all sucks for the average retail investor. Those without the net worth to be allowed to invest in private equity or venture capital opportunities are now cut out of a fast growing, lucrative market. Many of these same retail investors belong to public or union pension funds that have agitated for this two-tiered capital market, where the rich have more choices than average workers.

The SEC has long left sophisticated investors alone precisely because they need the least protection. The private companies that have these investors on their boards are presumed to be adequately governed. Yet we now have a top regulator telling some of the winningest companies on earth that they are losers for not joining her club.

Add A Comment