Posted by Marc Hodak on May 27, 2014 under Economics, Innumeracy |

Whenever minimum wages are being debated, as they are once again, we can count on someone bringing up the old story about Ford’s $5-a-day gambit. It goes something like this:

Ford Motor founder Henry Ford revolutionized the industrial landscape when he doubled his employees’ wages to $5 per day in 1914. The pay increase allowed his workers to buy the Model T cars they assembled every day on the factory line.

Enabling workers to “buy their own product” supposedly enables the creation of a mass market, helping producers as well as consumers. But is that true? And is that how Ford benefited from his wage hike? Let’s look at the math.

In 1914, when Ford Motors instituted the $5-a-day wage, the company had about 14,000 workers making $2.25 a day, for a total wage cost of about $32 million. Ford was selling about 250,000 cars a year at about $500 per car. That’s about $125 million in total revenue. So, let’s say that ALL of the increase in wages–$2.75 per day per employee for all 14,000 employees–went toward the purchase of Ford cars. (Why that would have been impossible is a story for another time.) That would be sales of about 20,000 more cars (yes, more than one car per worker), yielding Ford about $10 million dollars more in revenue. So, the “buy-their-own-product” folks are asserting that Ford benefited by doubling his labor costs in order to increase his sales by less than 7 percent. For one year.

Nope.

The buy-their-own-product rationale is as historically mistaken as it is economically ridiculous. Ford’s stated intent in dramatically raising wages was to reduce the huge turnover his new assembly line process had created, and the high costs of dealing with that turnover. In other words, it was a bold solution to a novel production problem.

Furthermore, far from expecting any major increase in sales (i.e., from his own workers), Ford counted on having his profits significantly reduced that year as a result of the wage increase. In fact, he was gleefully counting on it. Why would Ford want his profits hurt that year? Because he was in the middle of an outrageous gambit to squeeze out his fellow investors (and new car competitors) John and Horace Dodge, and a ding to the company’s profits that year would hurt them much more than it would Ford himself. Ford, in fact, expected to realize the benefits of lower turnover in later years once his volume was greatly expanded (which is what eventually happened).

The idea that increasing your employees’ wages to enable them to buy your product is one of those ditzy notions that requires math blinders to believe. Yet the “buy their own product” argument will continue to be made because belief is more powerful than math.

Posted by Marc Hodak on April 28, 2014 under Pay for performance |

If I were a wheelwright, I would probably raise an eyebrow at stories like “Philadelphia man invents the wheel.” Since I create organizational incentives for a living, that was my initial reaction to this story, via the NYT:

In August, I wrote about the design and implementation of a profit-sharing plan for my business. I decided to try this because my company has a long history of producing poor (or no) profits…

The plan began with the second quarter of 2013, and here’s how it has worked out: We made a profit in three of the four quarters that followed.

It’s easy to joke about someone reinventing the wheel, but there is a difference between creating wheel, and creating a wheel that doesn’t come off when the road gets a little rough. A good incentive plan only gets that way after considering what, exactly, we want to motivate, and designing the plan to do that using the minimum number of moving parts needed to function effectively. I was impressed with the way this business owner went through that process, and what he ended up with:

If there is a profit, 30 percent of it goes into a profit pool. Half of that pool is split among all of the workers except me (because I keep the other 70 percent), and the other half is split just among the production employees (everyone except the two commissioned salesmen and the bookkeeper). The splits are all even, meaning lower paid and higher paid workers get the same share. If there is no profit in a quarter, there is no payout. A loss in one quarter gets subtracted from the subsequent quarter’s profits before any bonuses are paid out — but I don’t claw back previous bonus payments if there is a loss in a subsequent quarter.

Plans like this are becoming rarer, especially at larger or public companies. Of course, no plan is perfect. This plan was designed to encourage teamwork and a holistic focus on the business. I’m sure this owner will at some point get grief from his most productive people for pulling along the free riders. And he will be dealing with morale and retention issues when the market turns against his company for more than a couple of quarters. Whatever he does to ameliorate or prevent those problems will beget others. That’s life.

Nevertheless, his plan is impressive. This owner did not create sports car wheels for a motorbike, and he did not create the wheels within wheels that many compensation experts would consider “best practice.” He just thought about what he needed to get his business to the next level, and used his authority to do it right and keep it simple.

Posted by Marc Hodak on April 14, 2014 under Executive compensation, Governance |

Private companies have a natural governance advantage over public companies – one that stems mainly from the presence on their boards of their largest owners. This governance advantage is reflected in the greater effectiveness of private company executive pay plans in balancing the goals of management retention and incentive alignment against cost.

Private company investor‐directors are more likely to make these tradeoffs efficiently because they have both a much stronger interest in outcomes than public company directors and more company‐specific knowledge than public company investors. Furthermore, private company boards do not have to contend with the external scrutiny of CEO pay and the growing number of constraints on compensation that are now faced by the directors of public companies.

Such constraints focus almost entirely on one dimension of compensation governance – cost – in the belief that such constraints are required to limit the ability of directors to overpay their CEOs. In practice, any element of compensation can serve to improve retention or alignment, as well as being potentially costly to shareholders. Furthermore, any proscribed compensation element can be “worked around” by plan designers, provided the company is willing to deal with the complexity. For this reason, rules intended to deter excessive CEO pay are now effectively forcing even well‐intentioned public company boards to adopt suboptimal or overly complex compensation plans, while doing little to prevent “captured” boards from overpaying CEOs.

As a result, it is increasingly difficult for public companies to put in place the kinds of simple, powerful, and efficient incentive plans that are typically seen at private companies – plans that often feature bonuses funded by an uncapped share of profit growth, or upfront “mega‐grants” of stock options with service‐based vesting.

All of this is detailed in my newest article published in the Journal of Applied Corporate Finance.

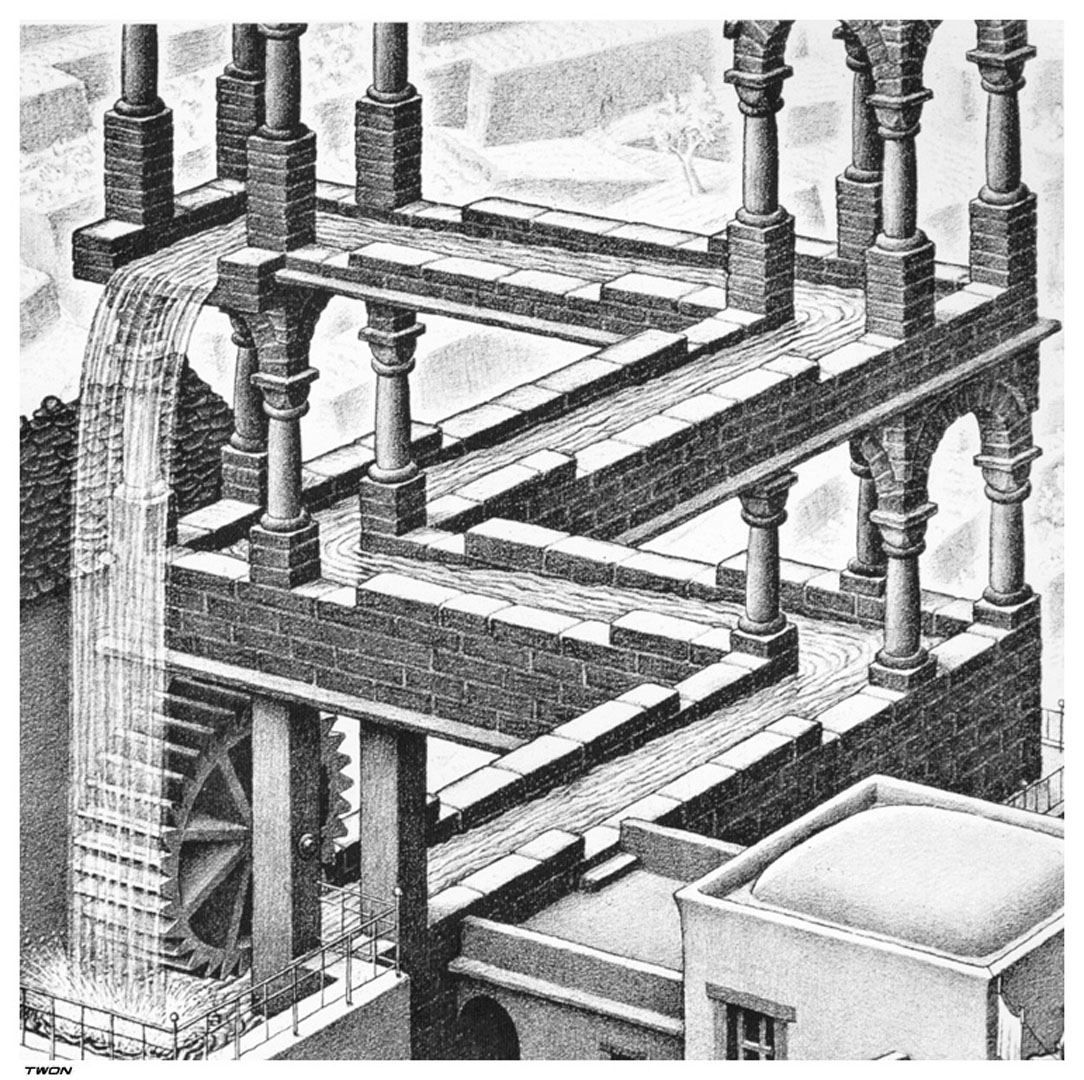

Posted by Marc Hodak on March 23, 2014 under Governance, Invisible trade-offs |

Transparency has its benefits. It enables shareholders to see into the company they own, and thereby judge whether it’s worth owning. The main mechanism for transparency in the corporate world is company disclosures. Does that mean that more disclosure is better? This article suggests otherwise:

In a coming paper in the Journal of Finance, Messrs. Loughran and McDonald suggest that size may be what really matters. They studied 66,707 10-Ks filed for the years 1994 through 2011. Controlling for factors including size and industry—bigger or highly regulated companies naturally file longer 10-Ks—they looked at how well the stock market appeared to read the performance of companies with lengthy filings.

Answer: Not so well. In the weeks after filing, shares of those with longer reports tended to be more volatile than those favoring brevity.

Somewhere along the line, disclosure became synonymous with transparency. Particularly in eyes of many governance mavens. Perhaps that’s because, since 1933 at least, the ability to compel disclosure has been the main tool in the federal regulatory tool chest. When you have a hammer…

I often introduce the Enron case with its 10-K from the year before the firm’s implosion. It’s difficult to go through that tome, including the volume of data on its infamous Special Purpose Entities, and claim that insufficient disclosure was the culprit. Their management accurately, if literally, conveyed the complexity of its operations.

This new study begins to explain how disclosure is not the same thing as transparency, and why the “more is better” instinct may be leading us astray.

Posted by Marc Hodak on February 25, 2014 under Executive compensation, Stupid laws |

Paradox: a statement that is seemingly contradictory or opposed to common sense and yet is perhaps true

The media in Europe are starting to call skyrocketing banker salaries across Europe the “bonus paradox.”

The EU limit on bonuses to 100 percent of salary (or 200% with shareholder approval) is ushering a paradoxical parade of unintended consequences. But just because consequences are unintended doesn’t mean they are unpredictable.

The economic ignoranti fully expected overall banker pay to be clipped by the EU measure. José Manuel Barroso, president of the European Commission said, “This is a question of fairness.” So, there it is.

Except that banks are not going to lose their most mobile workers for insufficient pay. Bankers, you may not be surprised, are good with money; they know what they are worth, and they are confident about it. They would actually prefer to be paid for performance, and are unhappy about the higher mix of fixed-to-variable compensation that effectively caps their upside, even if it leaves them more-or-less whole in expected value terms. But they will not accept less than what the guy down the street, or in New York or Hong Kong, will pay them.

The more sophisticated proponents of this law would say that it wasn’t the level of pay they were actually after, but the structure of pay in the form of bonuses that encouraged undue risk taking. They’re OK with the new compensation mix, and feel it will reduce financial risk. They are wrong, too. Yes, it is theoretically possible that perverse incentives can lead to undue risk-taking, and there was certainly some of that going on in the lead-up to the financial crisis. But there is zero evidence that bonus structures that have been around for decades, and whose incentive effect have been understood and refined and overseen for decades, would all of a sudden in the middle of the aughts suddenly be the cause of a global catastrophe. If you want to properly diagnose a cause, look at what has changed, not at what was always there. If that logic doesn’t persuade, then perhaps empirical evidence would, and the evidence denies the hypothesis. If logic and empiricism don’t sway you…then you are fully qualified to run for the legislature.

Unfortunately we are not done with paradoxes and unintended consequences. Read more of this article »

Posted by Marc Hodak on February 10, 2014 under Governance, Self-promotion |

I am excited to announce a new online resource for corporate professionals interested in ethics, governance, and related business issues: EthicalSystems.org. The idea behind Ethical Systems is to provide academic rigor to work on improving the ethical behavior of organizations.

This site is the brainchild of Jonathan Haidt, the brilliant NYU researcher and author of the bestselling “The Righteous Mind.” Jonathan was grappling with the fact that ethical behavior has, thus far, been profoundly resistant to improvement via formal training. So he corralled some world-class researchers* to develop individual pages devoted to specific topics such as Cheating, Corruption, Leadership, and (of course) Corporate Governance.

Take a look at it, and feel free to send comments or ideas to the researchers managing the pages. This is intended to be a collaborative effort not just among academics, but between academia and the businesses this initiative is intended to serve.

* As the person maintaining the Corporate Governance page, I am definitely the least distinguished of this group

Posted by Marc Hodak on January 26, 2014 under Executive compensation |

About a year ago, I wrote about the new restrictions the EU imposed on banker bonuses, i.e., limited to two times their salaries. I predicted that bankers, being better versed than legislators on how money works, would likely nominally raise salaries, then claw back a portion of that nominal salary based on performance. One year later, it appears that is pretty much what Goldman Sachs and Barclays (at least) are doing:

Starting this year, certain Goldman employees will earn a salary, a bonus and some “role-based pay.” It may be paid monthly or divided, with some paid monthly and some accruing to be handed out at the end of the year. The new type of pay will not be used when tallying pension contributions. The bank may be able to claw some of it back, and it can change from year to year. But it will have the effect of driving up base salaries.

Yes, to some extent base salaries are going up, but the deferred portion subject to claw-back serves exactly the same function as a target bonus that is realized (or not) based on performance. And this bumped up “salary” provides enough headroom to provide double the amount again for bonuses.

For an example, here is how the numbers worked for Goldman. Last year, average salary for Goldman employees covered by the new law was about $750,000, and their average total pay was about $4.5 million. This year, Goldman bumped up these folks salaries by about $1.5 million, for a total “salary” of $2.25 million. Half of that “salary” increase (hence the quotes), i.e., $750,000, is subject to a performance-based clawback. If, instead, the employee performed well, they would get their total “salary” of $2.25 million. If they performed very well, they could get another $2.25 million, for a total pay of about $4.5 million. In other words, they could end up exactly where they were before, but via a more complicated path to be in compliance with the letter of the law.

If you can’t follow these numbers, that’s OK, you could still become a legislator. If one were serious about containing bankers’ pay, they would be pursuing a very different, more finance-literate path of regulation. I’m not holding my breath.

* That’s a longer headline than “Dog bites man,” but I must be cognizant of what search engines will pick up.

Posted by Marc Hodak on December 15, 2013 under Governance, Regulation without regulators |

Aubrey McClendon, former CEO of Chesapeake Energy Corp. (which, as far as I know had nothing to do with the bay near where I grew up), is pulling in billions in new capital via his American Energy Capital Partners LP. The partnership will have some unusual governance features:

American Energy Capital also disclosed a range of potential conflicts of interest. The sponsors can favor their own interests over those of investors. In addition, the partnership may invest in oil and gas properties where Mr. McClendon’s firm has interests. Mr. McClendon’s management group won’t owe a fiduciary duty to the partnership, according to its registration statement.

Now, would I buy into a partnership with such conflicts? Probably not.

Would I prohibit anyone else from buying into such conflicts? Definitely not.

This partnership may or may not prove to be as good a deal for its investors as Chesapeake was for theirs. I would leave it to others to discern the bet they are making. But I would not prevent them from making their bet. And once they buy into this partnership, I would not favor the government forcing a change to the rules they bought into for the sake of “good governance.”

If all this makes sense to you, and I know it won’t to everyone, then you should be disturbed when public companies are forced to reform their governance through a federalization of corporate rules that supersede their charters. We can’t know that such “reform” will enhance the returns of outside shareholders; no governance regulation adopted by Congress over the last couple of decades had any empirical support that it would actually help shareholders, either before it was adopted or after it was implemented. But we do know that the reforms will cost every company in three ways:

(1) The Compliance CAFE (Corporate Advisers Full Employment)

(2) The occasional cost of sub-optimal decisions because of decision-making constraints created by the rules, i.e., unintended consequences

(3) The costs of lawsuits alleging a breach of the rules, regardless of their actual breach, because it is often less expensive to settle these suits than to fight them and win, i.e., the Plaintiff Lawyer’s Tax

This is not to say that we shouldn’t have any rules with regards to corporate governance. But I would suggest that the rules agreed upon by the original parties to the transaction should be given much more of the benefit of the doubt than those dreamed up by a meddling Congress. Even bad bets contribute to our progress.

Posted by Marc Hodak on December 2, 2013 under Governance, Politics |

New SEC Chairpersons tend to bring along new priorities. Mary Shapiro, former FINRA regulator, brought a strong regulatory agenda. Mary Jo White, former United States Attorney, is bringing a strong prosecutorial agenda. This shift in priorities appears to have manifested itself in a new Rule List that, at least for now, drops the push for disclosure of corporate political contributions. The pro-regulatory crowd is not going to be happy.

Corporate political spending has been a hot topic since Citizens United in 2010. This ruling gave corporations and unions the ability to spend without limit on political ads, as long as they did not directly contribute to a candidate’s campaign. The people pushing hardest for corporate disclosure of such spending have—no surprise—been those most opposed the policies that corporations are most likely to promote, e.g., less regulation, lower taxes, and reduced trade barriers.

Of course, these political opponents aren’t going to argue that corporate America should not spend money on politics just because they oppose their policies. Americans won’t accept selective application of First Amendment rights. Instead, these opponents have taken a subtler tack, arguing that good governance requires greater transparency.

Read more of this article »

Posted by Marc Hodak on November 11, 2013 under Executive compensation, Governance, Invisible trade-offs, Pay for performance |

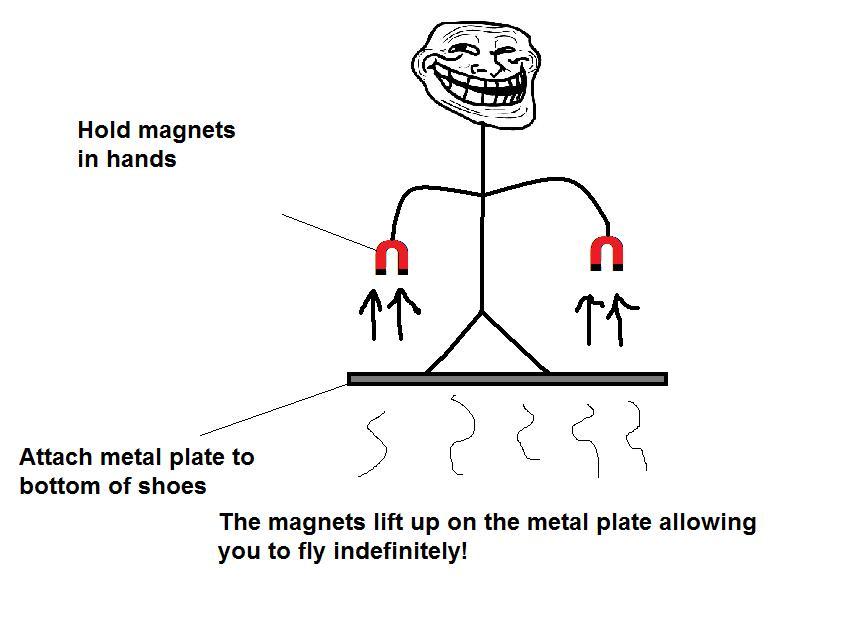

Pay for performance seems like such a simple idea, and easy to accept as a basis for judging executive compensation. So why does it continue to create such discussion and controversy? Well, consider the following grid:

The key distinction is managerial performance versus company performance. An easy way to understand this distinction is to consider a gold mining company when the gold price has dropped significantly, but our company’s profits and stock price have dropped less than half of anyone else’s in our sector due to extraordinary management. It’s easy to see in such an example that our management has done great, but our shareholders have done poorly. Should such managers get a bonus?

When management and shareholder performance are strong, as in the upper right quadrant, the answer is obvious. When management and shareholder performance are weak, as in the lower left quadrant, the answer is obvious.

But what do we do when our gold company finds itself in the upper left quadrant? If we pay a bonus for this situation, we are open to the accusation of pay without performance by our investors. Our investors might bother to look at relative performance, in which case they might forgive bonus payments up to a point. But there is no way outside investors can gauge what the board can, i.e., that our managers actually did a great job given their situation, and that denying them a bonus may entail a significant risk of losing them to other firms that promise to compensate them for being great managers.

Paying a bonus for lower right quadrant performance is equally problematic. Most shareholders will let you get away with it because they are feeling flush. But those that don’t are on firmer ground in saying it would be pay without performance, that management was simply in the right place at the right time. In this situation, the downside to not paying a bonus is a little more subtle. If we deny managers a bonus for poor relative performance in the face of good absolute performance, then we MUST be willing to pay them bonuses for good relative performance even when the company suffers poor absolute performance. In other words, boards justifiably refusing to pay bonuses when they are in the lower right quadrant will eventually they find themselves in the upper left quadrant having to pay bonuses, or risk almost certain loss of their best managers. And we already highlighted the difficulty in adhering to a policy of consistently paying for relative, as opposed to absolute performance.

True to their pragmatic form, many boards resolve this dilemma by paying for both absolute and relative performance. This makes the plans more complicated, and does not completely eliminate at least some criticism of pay without performance, but it at least attempts a workable compromise. Fortunately, ISS (pdf) and Glass-Lewis provide a least some cover for pay for relative performance, but that only gets you so far.

What would you do?