Posted by Marc Hodak on August 8, 2009 under Politics |

In looking over the rush of bills being proposed by this congress to regulate corporate governance, I fished out this one by Congressman Keith Ellison (D-MN), called The Corporate Governance Reform Act of 2009.

A skeptic might ask what a civil rights and labor lawyer might know about corporate governance. Has he ever advised a corporate board, or even attended a board meeting at a for-profit company? In Ellison’s defense, one could say that governance is not just a concept applicable to corporations. Every organization has governance mechanisms dictating what people need to do to obtain, retain, and exercise power. That includes the organization whose average member controls about $6.5 billion in spending–the U.S. Congress. What governance lessons would Mr. Ellison have learned from his experience with that institution?

1) Figure out what your constituents’ needs and preferences are, then use that info to campaign to win enough of their votes to get elected.

2) Once in Congress, serve as a voice for your electorate, adding your ideas and judgment to the debate of the great issues of the day….

Ha ha. Just kidding. Here is what he really learned:

Read more of this article »

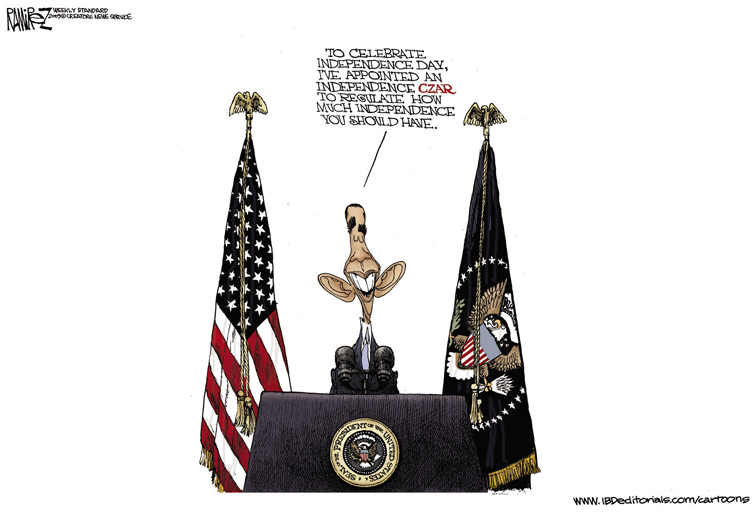

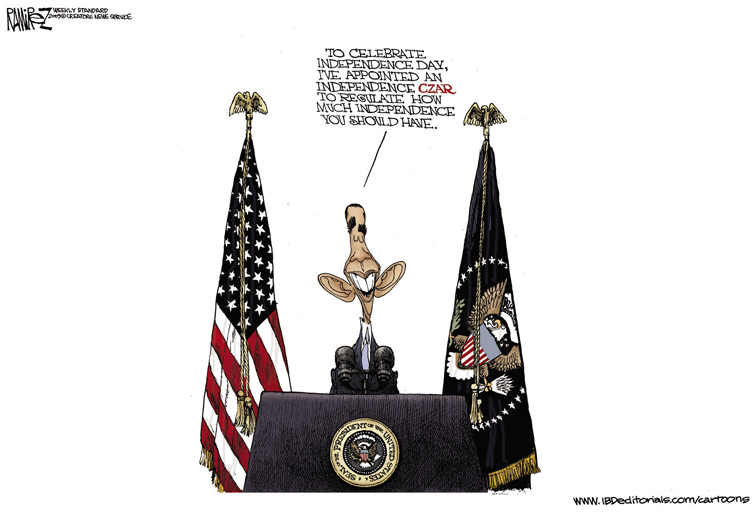

Posted by Marc Hodak on July 27, 2009 under Executive compensation, Politics, Reporting on pay |

This paragraph says it all:

With public anger high over the rich pay packages awarded to some financial executives, Mr. Feinberg must walk a fine line between curbing pay at companies benefiting from taxpayer funds while not squeezing compensation so hard that it hurts the ability of companies to lure talent.

Mr. Feinberg is nicknamed the “Pay Czar,” no doubt because the Czar was such an inspiration in making the right trade-offs between populist demands and economic needs.

The irony is that Feinberg’s grandparents, like my own, may very well have been folks who escaped the Czar’s anti-semitic pogroms in the early part of the last century. We wouldn’t dream of nicknaming to Feinberg an “Oberfuhrer.” Perhaps a Commissar, Sotto Capo, or Underboss might be just as good. If not, why do so many people consider a ‘czar’ such a desirable thing in a free country?

Sounds good to me

Other Michael Ramirez cartoons

HT: Mike Perry

Posted by Marc Hodak on July 25, 2009 under Executive compensation, Politics, Reporting on pay |

It appears that Citi is on the hook for $100 million to the head of their Phibro division.

A top Citigroup Inc. trader is pressing the financial giant to honor a 2009 pay package that could total $100 million, setting the stage for a potential showdown between Citi and the government’s new pay czar.

The New York Times and Wall Street Journal, who would consider it well beneath them to publish front page stories about Jennifer Aniston’s romantic travails, have no qualms regaling the mob with stories about big dollars going to unpopular executives–the MSM’s version of porn for the business pages, which they peddle in the brown paper bag of “governance issues.” The government is easily embarrassed by these big dollar stories, which sets up “the showdown.”

So, am I suggesting that Andrew Hall, the guy in line for this bonus, is worth $100 million a year? No, I’m not. I’m sure he neither needs or deserves this princely sum. I’m simply suggesting that he should get what his contract says he should get.

A former official recently told me, “hey, contracts get challenged and renegotiated on Wall Street all the time, so why are you so upset when the government is doing it?”

I’m not upset when the government does it the way private firms typically would. A Wall Street firm renegotiates contracts quietly, to avoid the perception that they take their agreements lightly. No bank, however “powerful” they may be, could keep their doors open a fortnight if they could not be counted on to keep their word on a deal.

In contrast, the government uses these public spectacles to flaunt its disrespect for contracts, standing in a champion’s pose before the cameras, ignorant or uncaring that their knock-out is a blow to the rule of law.

Read more of this article »

Posted by Marc Hodak on July 22, 2009 under Collectivist instinct, Executive compensation, Politics, Scandal |

Missouri state's HR department

The nice people at MOSERS, the Missouri state pension fund, had a bonus plan. They beat their targets, earning their bonus. The Governor and legislature denied them their bonus.

Governor Jay Nixon called $300,000 in bonus payments to the 14-member staff of the Missouri State Employees’ Retirement System (MOSERS) “unconscionable.”

Unconscionable? What happened?

MOSERS’ incentives are based on a five-year cycle. The bonus payments paid this year were based on fund performance from January 1, 2004, through December 31, 2008. In that period, says [Executive Director Gary] Findlay, MOSERS had an overall return of 3.9% compared with its benchmark of 1.8%. (the benchmark is the performance of the asset allocation if it were invested passively).

The difference to MOSERS between a 3.9% rate of return and a 1.8% rate of return over that period, points out Findlay, is $600 million. So, the MOSERS investment staff added $600 million in value to the fund’s assets for bonus payments of $300,000, which is 5/100 of 1%.

So, tell me again, why did the politicians hose the MOSERS fund managers?

[Chairman of the legislature’s pension committee, Senator Gary] Nodler argues that payment of bonuses makes no sense in any year in which the fund experiences no actual growth. When the fund loses money, he says, then there is no money from which to pay the bonuses except to go into current assets. And that, he says, is a misappropriation of funds and a breach of fiduciary responsibility.

Makes no sense, indeed.

I give Nodler points for creativity, however. I have never heard a “breach of fiduciary responsibility” allegation used to cover up a breach of contract and a breach of good faith. You have to have a highly cultivated sense of mendacity to make this stuff up while summoning outrage for the cameras.

If the politicians had a shred of integrity, they would have told their pension fund managers five years ago that they would under no circumstances get any bonuses when absolute returns were negative. That way, the managers could have evaluated their compensation fairly versus their other opportunities, and decided whether they wished to stay or take their talents elsewhere. Given that the pols agreed to a bonus plan, their ignorance of its terms, or difficulty in explaining to the public why they are making payouts, is not a reason to stiff their employees. At best, if they decided after the fact that they wanted to pay for absolute performance rather than relative performance, then they should recalculate the bonuses earned in past years under this plan on an absolute basis, and pay them consistently. As it stands, the Missouri politicians were content to pay bonuses based on relative performance when peer fund returns were positive, but for absolute returns when the funds are negative.

And that is why politically run systems can’t outperform private sector ones.

Posted by Marc Hodak on under Invisible trade-offs, Politics |

Liberal blogger Ezra Klein is dubious about Obama’s pleas to progressives: that whatever happens in each house of Congress, he will fight in conference to uphold his “bottom lines,” which consist of affirmative answers to these questions:

Does this bill cover all Americans? Does it drive down costs both in the public sector and the private sector over the long-term. Does it improve quality? Does it emphasize prevention and wellness? Does it have a serious package of insurance reforms so people aren’t losing health care over a preexisting condition? Does it have a serious public option in place?

Never mind that he’s claiming with a straight face that a central planning system, which is what a “serious public option” will inevitably devolve into, is likely to produce a combination of widespread availability, decreasing costs, and improving quality–something that no government-run system has ever produced whether it be shoes or schools. And after all this, Professor Bainbridge feels Obama has left some things out:

- Nothing about Americans being able to keep the doctor they have now

- Nothing about Americans who are satisfied with their health care insurance being able to keep their existing policy

- Nothing in it about preserving opt-outs so that those who don’t want socialized medicine can keep private plans that fund procedures and drugs the government is unwilling to cover

- Nothing about how to pay for it without raising taxes to global highs

And then there is that thing that Obama, the progressives, and nearly every one else has left out in their “bottom line,” i.e., the prospect of finding cures for nasty things that don’t happen to have yet been cured. Innovation continues to be the ignored trade-off.

Posted by Marc Hodak on June 19, 2009 under Invisible trade-offs, Politics |

I picked up today’s Wall Street Journal this morning and saw a picture of two old Latvians literally at each others’ throats. The story behind that pic is that Latvia has promised pensions and public sector jobs to many, many people. Now that it can’t fund that promise (which was likely predictable at the time the promises were made), and is proposing to cut back 10 percent on pensions and 20 percent on public sector wages. My guess is that one of the people in the picture is a pensioner, and the other is a public sector employee, or spouse of one. My certainty is that they are frustrated by the perceived betrayal of their government, the reality that the losses are not going to hit everyone evenly, the reality that political influence will determine who gets what, and that they don’t have any. So they do what people often do in that situation–they turn on each other. Whenever the government must choose among the recipients of its largess, especially as it withdraws it, it is bound to create social strife.

You also see an echo of that in the headline story “Corporate Lenders Get Hit,” which describes how proposed rules for lending won’t hit all lenders evenly, and may even drive certain types of lenders out of the market. In this case, the disfavored lenders are figuratively hitting back via their lobbyists.

If one takes political debates on economic issues at face value, one can be forgiven for thinking that trade-offs are never necessary. Each side argues from an “all we need…” advocacy. When they admit of any conflicts their scheme may create, they invariably assert that sensible bureaucrats can make sensible trade-offs against fair standards, never admitting that fairness is impossible when the standards are arbitrary, and that nearly every standard creates, at its contentious, man-made boundary, winners and losers, often in the millions.

But when tough choices need to be made, as they always will be with the imposition of man-made rules, we are also apparently amused by pictures of people at each other’s throats, as long as it’s not us in those pictures.

Posted by Marc Hodak on June 15, 2009 under Executive compensation, Invisible trade-offs, Politics, Unintended consequences |

The government, purveyor and practitioner of the most perverse incentives on the planet, is coming down the road with a cart of new remedies for incentive compensation:

“This financial crisis had many significant causes, but executive compensation practices were a contributing factor,” Geithner said in his statement on Wednesday. “Incentives for short-term gains overwhelmed the checks and balances meant to mitigate against the risk of excess leverage.”

It is, indeed difficult to pinpoint all the potential causes of the financial crisis, and it’s certainly plausible to point the finger at bank compensation. The politicians and media would have us believe that:

A consensus has grown in Washington that compensation incentives based on short-term profit encouraged excessive risk taking at banks and played a major role in creating the financial crisis.

But the manner and degree to which bank compensation is at fault is, in fact, quite speculative. Read more of this article »

Posted by Marc Hodak on June 14, 2009 under Economics, Politics |

Compare this item of health care reform being proposed by the Administration:

“The president does not want to dismantle privately owned plans. He doesn’t want the 180 million people who have employer coverage to lose that coverage. He wants to strengthen the marketplace,” Sebelius added.

with this:

President Obama, in a pivot from some of his harshest campaign rhetoric, told Democratic senators yesterday that he is willing to consider taxing employer-sponsored health benefits to help pay for a broad expansion of coverage.

Versus this more recent pronouncement of Obama’s second:

Vice President Joe Biden opposed proposals being discussed by some lawmakers to tax health insurance benefits provided to people by employers as a way to pay for an overhaul of the $2.5 trillion U.S. healthcare industry.

Which indicates that Obama is waffling either on his committment to not tax these benefits, or to consider taxing them, or that Biden hasn’t gotten the most recent memo. History shows that all three are possible, even at once, in terms of political positions. As economic propositions, though, the government will have to make a trade-off: reduce private health care by taxing it, or paying for public health care by raising the money elsewhere. Reality, unlike politics, won’t allow you to have it both ways, let alone all three.

Posted by Marc Hodak on June 9, 2009 under Collectivist instinct, Politics |

The formula accepted by every political leader: Max(societal good) = MM+MP. Here are the terms:

MM = More money

MP = More power

Every government official will tell you, there is no problem they can’t solve if only you grant them MM+MP. As long-time readers know, I have come to facetiously label this formula Hodak’s Law, since it is so commonly, universally invoked by politicians, and credulously reported by the press. Tim Geither is clearly no exception.

Posted by Marc Hodak on June 8, 2009 under Politics |

Or that’s what I thought. Here is a description of a recent celebration for every banker’s favorite guy:

Last week, 600 people, including executives from Goldman Sachs and J.P. Morgan Chase, filled the cavernous National Building Museum in Washington, D.C., for a $5,000-per-table tribute to the chairman of the House Financial Services Committee. He is marshaling legislation that promises to make Wall Street a more regulated and less prosperous place for years to come, and to hear it from some of the bankers at the event, they couldn’t be happier that a tough-talking, capital-L Liberal Democrat from Massachusetts is leading the charge to rewrite their futures.

Yes. Couldn’t be happier.