Posted by Marc Hodak on January 28, 2009 under Invisible trade-offs |

Forbes has been highlighting the Consumer Product Safety Improvement Act in a series of articles by Walter Olson and Paul Rubin. These articles provide an excellent example of regulatory overkill, and how doing “for the children” invariably ends up doing it to those children’s parents, with little noticeable benefit for the children themselves.

Meanwhile, the safety nannies are keeping the pressure on. In a typical “it’s for the kids” logic, consumer advocates continue to point out that (a) lead is bad, and (b) the bill passed by an overwhelming majority (“we’re all parents and grandparents”). They also helpfully point out that some congressmen, responding to howls of protest, have already offered some advice to the CPSC on how to keep the implementation costs down, advice it’s not clear the CPSC will be able to follow. And don’t you know, those business ingrates are still not happy.

What the consumer advocates ignore is that this law simply makes no sense. It is founded on the principle that people who sell things to kids are indifferent to any injury they might cause. Toy makers, who completely depend on the happiness of their little customers, happen to know lead is bad. That’s why Mattel reacted the way they did when they found out. What keeps them awake at night is not the possibility of offending the effete sensibilities of the safety nannies, it’s the possibility of losing their customers.

And, also, if the number of congressmen rushing to pass a bill in hysteria is the measure of a bill’s virtue, then my troubled, liberal friends should have no problem with this.

Posted by Marc Hodak on January 14, 2009 under Invisible trade-offs, Unintended consequences |

Why, they create regulations, of course. But to what end? The nominal purpose of regulations is to create the impression of increased safety or security. For instance, regulating workplace safety nominally gets us safer workplaces. Regulating food safety nominally gets us safer food. Regulating financial service providers is supposed to make the markets safer for various participants. People vote for regulations because it makes them feel safer.

Of course, one would hope that regulations create more than the impression of safety. People want and expect that the safety is real. Goodness knows, the costs of regulation are real–one would hope we are getting the benefits.

Larry Ribstein notes a great example of how the impression of safety can actually create greater danger. When the SEC, the promulgators and enforcers of securities regulation, investigated then signed off on Madoff’s fund, they became an unwitting accessory to the confidence game that Madoff was playing with his clients. In the case of the Swiss bank UPB, the SEC literally created confidence in an operation the bank would have otherwise treated with suspicion, costing their clients hundreds of millions of dollars.

Economically speaking, one would like the benefits of regulation to be greater than the costs. Unfortunately, these things are difficult to measure. The benefits are largely speculative, e.g., accidents that don’t happen, while the costs are relatively dispersed, e.g., a few dollars per item that may be sold by the millions. The lesson, here, is that there is another cost–the cost of misplaced confidence. If one believes that someone else is bearing the monitoring and other costs to improve their safety, then one is likely to save on those costs for themselves. It’s easy to visualize that for every extra dollar I am forced to spend for regulatory compliance for a particular product, I might save a dollar or more that I would have otherwise spent for the Good Housekeeping seal on that product. In other words, by taking on the regulation of a product or sector, the government is socializing costs that would have been otherwise borne by private actors, possibly with a net negative effect.

I don’t rely on any private tester of milk or beef because the USDA is certifying it for me. I know that the SEC is watching over registered brokers and other market agents, so I can trust them. Even if I thought the regulators did an inferior job versus a private certificate of approval, I’m not going to pay double for the inspection. Government regulation will generally crowd out private regulation.

In the case of Madoff, UPB bore the private costs of regulation, but they also knew that the SEC actually looked into the fund’s operations, and gave it an OK. Absent that OK, the bank would have relied on its internal analysts who were sounding warnings about Madoff’s fund.

Unfortunately, these kinds of regulatory embarrassments rarely improve regulation. They more often end up increasing the costs of regulation on a thousand perfectly good firms for every crooked one out there, which can easily be a net drain on social welfare. And then, the government enhances confidence among the credulous voters who have somehow come to believe in the effectiveness of government.

Then, another $50 billion goes poof. And the regulators use that as proof that they don’t yet have enough money and power.

Posted by Marc Hodak on December 30, 2008 under Invisible trade-offs, Scandal |

A Reuters reporter created a story that began like this:

Cynthia Goldrick’s daughter is in and out of the hospital for brain surgery, her mother has Stage 4 lung cancer and her father has moved into a home for the elderly.

So when the Goldrick family’s adjustable rate mortgage reset while husband Patrick was off work for a job-related injury, it eliminated the thin margin between their income and the mortgage payment and put them on the road to foreclosure.

While these circumstances may seem extreme — a perfect storm of bad luck — the basic economics of a hike in mortgage rates and a bank’s inability or unwillingness to modify terms have been shared by many Americans over the past year.

Let me see if I got this story right. A family runs into horrible luck with their health. The adjustable rate on their mortgage adjusts. Lots of people saw their adjustable mortgages adjust up. I think what this story is aiming to do is link the hike in the family’s mortgage to their foreclosure, and claim that this is symptomatic of a nationwide problem with mortgages. But this is a strange tale.

First of all, this family is faced with losing their home because of a string of factors, mostly health related, with the mortgage adjustment being just one of them. But a story has to have a villain, and they don’t want to blame God. Second, very few people are defaulting because they are suffering anything like bad luck visited on this family. It trivializes their plight to equate this family to the deadbeats who got mortgages they couldn’t afford, often under false pretenses, and the stupid lenders who indulged them.

Likewise, it doesn’t make sense to demonize the banks that gave this family money. Either the family deserved the loan at the time (in 2005), or they didn’t. Either way, the bank gave them the money. Now that this family is unable to pay back the loan, yeah the family risks having to downgrade to a cheaper home, but the bank is also faced with a disappointment that threatens its well-being. It’s hard for me to see how the banks are the bad guys in this story–which is clearly how they are portrayed–for the sin of trying to minimize their losses.

The end of this story includes a note that investors, finally seeing light at the end of the tunnel, are starting to come back into the mortgage market:

But that won’t help the Goldricks, who like many other families are in danger of losing their house and not likely to benefit from the $700 billion that Congress has allocated to Wall Street for bailing out financial institutions.

“I am absolutely bitter,” said Patrick Goldrick, who sees the scandal surrounding investment advisor Bernard Madoff as further evidence of Wall Street wrongdoing. “I am bitter toward Congress and bitter toward the big banks and the creepy billionaires who get away with stealing pensions.”

Bitter toward the big banks? Here is a family that had four major things go horribly wrong (plus the work-related injury, which was presumably temporary and covered by insurance). Of those four things, the only one that they consciously signed up for was the adjustable mortgage. They presumably didn’t want a fixed-rate loan–they wanted a step up from a cheaper rate to a more expensive one. The story doesn’t suggest that their choice about this was uninformed.

In fact, it’s possible that this family did, in fact, take on a loan they couldn’t afford long-term in order to help their sick daughter in the short term. I wouldn’t blame them for such a decision. I would probably make the same choice if it were one of my kids who desperately needed help. But I don’t think I would be bitter at the investors or the banks that gave me the money. The fact that Mr. Goldrick was indicates that he buys into the press’s distortion that the investors or their agents are the bad guys in this story.

I often warn my students that the job of the press is not to provide information–it’s to create stories. Stories sell papers. Facts are simply the building blocks of stories. Some facts are helpful to a particular story, some are not, and much of what makes a story good are the facts that are selected versus not. In this story, the helpful facts are the ones that create sympathy for a family that is hurting, enabling their situation to be crafted into a twisted version of an archetypal morality tale of good versus evil, David vs. Goliath, etc. The unhelpful facts are the ones that create ambiguities among the characters, each with their peculiar interests and incentives, exercising choices that are difficult to characterize along an ethical scale. Unhelpful facts create that noisy sense of life that you and I experience, without the forced overlay of comedy, tragedy, or drama.

Posted by Marc Hodak on September 20, 2008 under Invisible trade-offs |

Everyone heard yesterday morning about the Federal government basically agreeing to bail out the (remaining) financial firms. Everyone got a glimpse of the breathtaking cost of this bailout to the taxpayers. We also heard concern about “moral hazard” as a secondary effect, though that concept is hard for the average person to really get, especially the idea that this secondary effect may be even more economically costly than the nominal cost of the bailout.

What slipped by with nary a peep was the news later that day that GM drew down the remaining $3.5 billion of its credit facility.

To me, this looks a lot like your second kid, seeing the promise that you made to pay off the debt of your first kid, suddenly decide to tap out his own credit.

The Bush administration knew that one of the dangers of bailing out the financial sector is that other sectors were sure to pile on. Detroit was a logical choice. Especially in an election year where Michigan is a swing state. Can Ford be far behind? And Michigan is not the only swing state this close election…

Posted by Marc Hodak on September 11, 2008 under Invisible trade-offs |

I don’t know if Obama intended to call Sarah Palin a pig. I really don’t. But it can certainly be interpreted that way. Sure, the phrase “lipstick on a pig” is commonly used in Washington. Sure, McCain himself has even used it referring to Hillary’s health care proposal in 2007. But Hillary didn’t brand herself as the lipstick lady in 2007. Palin did two weeks ago. Everybody knows it. The media burned it into our consciousness. Before Nike, a teammate saying “Just do it,” was being supportive. After their ad campaign, he was being cliche. Same words, different time. That’s how marketing works. Obama knows this as well as anyone.

So Obama can complain all he wants about being unfairly tagged with a slur. Here’s what he’s pretending not to get. Let’s say Barack and Michele are drying dishes in the kitchen and he says something and Michele gets a look on her face. Barack doesn’t know where the look came from, but it’s not pretty. Barack says, “What’s wrong honey?” Michele says, “Did you just say I was a…” Doesn’t matter what she thought she heard. Doesn’t matter if he meant it. When it comes down to it, it doesn’t even matter if he really said it. All that matters is that she heard it. If you’re a guy, you’ve been there.

Read more of this article »

Posted by Marc Hodak on May 23, 2008 under Invisible trade-offs |

The Renewable Energy and Job Creation Act, among other things, reduces taxes on lawyers with an offsetting increase in taxes on investment managers and corporations. If that doesn’t sound like the kind of bill a Republican would vote for, think again:

Republican Congressman David Hobson supported the bill with the following justification:

“Probably the responsible vote is ‘no,’ but how do you explain that in a media that’s frantic over gasoline prices? Frankly, this has nothing to do with gasoline prices, but you can’t explain it, and it taxes the rich guys,” Hobson said.

What does this mean?

It means that he must have thought there was a pony somewhere in the manure pile that was this legislation.

As it turns out, most of this bill was aimed at extending tax breaks to a myriad of industries. Would he be inclined to support those? Well, let’s just toggle over to his list of biggest campaign donors to see who we meet. Hey, there’s PMA Group, one of the largest industry lobbyists on K Street pushing those production incentives for renewable fuels. Hi PMA! Then we meet Forest City Enterprises, a major beneficiary of R&D tax credits. Hi FCE! So, you see, Hobson wasn’t compromising his supposed principles, he was just showing gratitude to his biggest supporters.

Then, we meet Pioneer PAC. Hi Pioneer! Wait, whose Pioneer?

Read more of this article »

Posted by Marc Hodak on May 22, 2008 under Invisible trade-offs |

As Ted Kennedy begins his battle with cancer, we’re treated with a story about how his work in the Senate may be paying off in the form of his treatment choices:

“It’s really hard to think of anyone who’s helped biomedical research in this country or the National Institutes of Health more than he has, and hopefully he’ll get some benefit from how he’s helped others,” said Dr. Patrick Wen, clinical director of the Center for Neuro-Oncology at the Dana-Farber Cancer Institute in Boston.

Personally, I would consider it somewhat vindictive to wish upon Ted Kennedy the fruits of his health care policies. The good news is that Kennedy, like nearly all sufferers, will have no idea which of dozens or hundreds of treatments for his condition don’t exist today because of the costs of regulations that Kennedy supported over the last several decades (see below the fold).

I also hope that Dr. Wen is much better at connecting the dots in his research than he is between his last statement and this one:

Economics comes into play, as well. Simply put, the market for brain cancer drugs pales, compared with that for other malignancies, with only 9,000 people a year in the United States diagnosed with the kind of cancer that has beset Kennedy.

“Because the numbers are relatively small,” Wen said, “the incentive to develop drugs for brain tumors is less than for breast cancer or prostate cancer.”

Read more of this article »

Posted by Marc Hodak on under Invisible trade-offs |

Lou Pearlman was given an unusual sentence for defrauding investors of $300 million. He was nominally sentenced to 25 years in prison. However, the judge offered to reduce his sentence by one month for every $1 million Pearlman was able to return to his victims.

I’m not sure what the legal implications of such an offer might be, but the incentive issues are compelling. The first-order incentives are pretty clear: Pearlman has a strong incentive to return most, but not all of the money. Why not all? Because of economic laws, which are not subject to negotiation.

Pearlman is currently 53, so a 25 year sentence pretty much takes up most of his remaining life expectancy. I would bet that if he could buy his way out of that sentence in an all-or-nothing transaction, he would do so at any price. But most economic decisions are at the margin, and this one is one of them. As the sentence gets reduced, the marginal value of each month in prison is likely to go down. For instance, he may well decide that six months in prison is worth $6 million. I probably would. This remains true even if he’s resource constrained. For instance, if he only has enough to buy his way out of 15 years, he might still decide that the 121st month is worth an extra million, especially if he’s able to realize some returns on that million during the 10 years and a month he’d spend in the slammer.

The second-order incentives are a little more problematic. Regardless of whether Pearlman is resource-constrained or not, he’s simply paying for his crime at cost. If I defraud someone of a million, I shouldn’t be given the option of giving back that million and calling it even; there should be some extra penalty, either in cash or prison time (except that I personally don’t believe in swelling our prisons with non-violent offenders).

Also, is a million per month the right price? Or does the routine fraudster get a lower rate? Maybe it’s $100,000 per month for an executive? Or $10,000 per month for Guido? (Hey, I’m just sayin’.) More importantly, how much are prosecutor’s going to be selling freedom for? Government agents, like economic agents, will go with what the traffic will bear. So the question won’t be, “What is the appropriate price of freedom in this case?” It will be, “How much you got?”

I’m sure there are other considerations besides.

Posted by Marc Hodak on April 10, 2008 under Invisible trade-offs |

We’ve continually seen cases of a government agency that has failed using that failure as an excuse for more money and more power. I should name this the MM/MP phenomenon as a short-cut, since it’s the most common thing heard from government agencies. The current example is Congress considering expanding the budget and mandate of a Federal Airline Administration that is already largely ineffective and unnecessary.

The main premise of the FAA is that the government cares more about your safety than the airlines that serve you, as if the airlines were indifferent to the prospect of killing some of its customers and frightening the rest away. For anyone who thinks the FAA can do as good a job as the airlines themselves in monitoring safety, consider this comment from someone in a position to compare government versus private airline inspectors:

As a company that is a supplier and maintenance provider to airlines we are frequently audited by both the FAA and the QC departments of airlines. In general the airlines auditors are better, more thorough, and stricter, but at the same time more fair and consistent. Not being restricted to the “letter of the law” they can be flexible in areas where it makes sense and putative on issues that may not be technical failings but would cause problems. The airlines QC departments also act pretty independently and don’t seem to mind calling attention to an issue even if they know it will cause delays or hassles on the operations side. The FAA provides more of a bureaucratic hurdle, and from what I see makes decisions as seemingly arbitrary as that traffic cop. We recently had new inspectors for our district rotate in, and now we are enduring shut down threats over procedures that were fine for the previous 4 years under our old inspectors.”

I think most people would prefer dealing with a private company rather than the government, and would trust private companies to do better job than government. Unfortunately, the ones who don’t tend to run for office.

Posted by Marc Hodak on March 28, 2008 under Invisible trade-offs |

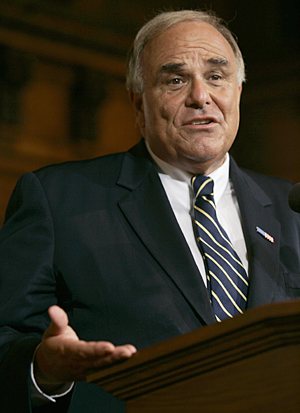

Governor Ed Rendell of Pennsylvania, that is. We’ve never hung out, but the Governor strikes me as a decent guy. He’s caring, intelligent, and has a sense of humor. His economic literacy, I’m not so sure about that.

Governor Rendell devoted his entire talk last night discussing our infrastructure. He noted that Pennsylvania and the rest of the nation are suffering horribly from deferred maintenance. He had the numbers to prove it. Good enough. But, there was one point he repeatedly brought up:

The states can’t do it alone. The states supply 75 percent of the spending on infrastructure, but it’s not enough. Ours is the only federal government among the wealthy nations that does so little for its infrastructure. The federal government has to be part of the solution.

So, I asked him:

Governor, isn’t that saying that the taxpayers of Pennsylvania should pay for infrastructure in Alaska, and taxpayers of Alaska should be paying for infrastructure in Pennsylvania? That bargain hasn’t worked well for Pennsylvanians in the past.

It was two questions, really. The first asked why he supposed there would be more money from the taxpayers collectively than there is from the sum of them individually. The second asked what benefit there was by taking the same pool of money and funneling it through Washington, D.C..

His answer to the first half would have been shocking if it didn’t come from a politician: “The federal government can always find the money.” That’s right, he literally said “find.” The money is out there, the government simply needs to “find” it. Nobody in the room who heard this non-answer seemed surprised. His answer to the second half was barely better: “We’d need to insure accountability in the distribution of such funds via a panel of experts.” We know how that works out.