Posted by Marc Hodak on April 14, 2014 under Executive compensation, Governance |

Private companies have a natural governance advantage over public companies – one that stems mainly from the presence on their boards of their largest owners. This governance advantage is reflected in the greater effectiveness of private company executive pay plans in balancing the goals of management retention and incentive alignment against cost.

Private company investor‐directors are more likely to make these tradeoffs efficiently because they have both a much stronger interest in outcomes than public company directors and more company‐specific knowledge than public company investors. Furthermore, private company boards do not have to contend with the external scrutiny of CEO pay and the growing number of constraints on compensation that are now faced by the directors of public companies.

Such constraints focus almost entirely on one dimension of compensation governance – cost – in the belief that such constraints are required to limit the ability of directors to overpay their CEOs. In practice, any element of compensation can serve to improve retention or alignment, as well as being potentially costly to shareholders. Furthermore, any proscribed compensation element can be “worked around” by plan designers, provided the company is willing to deal with the complexity. For this reason, rules intended to deter excessive CEO pay are now effectively forcing even well‐intentioned public company boards to adopt suboptimal or overly complex compensation plans, while doing little to prevent “captured” boards from overpaying CEOs.

As a result, it is increasingly difficult for public companies to put in place the kinds of simple, powerful, and efficient incentive plans that are typically seen at private companies – plans that often feature bonuses funded by an uncapped share of profit growth, or upfront “mega‐grants” of stock options with service‐based vesting.

All of this is detailed in my newest article published in the Journal of Applied Corporate Finance.

Posted by Marc Hodak on March 23, 2014 under Governance, Invisible trade-offs |

Transparency has its benefits. It enables shareholders to see into the company they own, and thereby judge whether it’s worth owning. The main mechanism for transparency in the corporate world is company disclosures. Does that mean that more disclosure is better? This article suggests otherwise:

In a coming paper in the Journal of Finance, Messrs. Loughran and McDonald suggest that size may be what really matters. They studied 66,707 10-Ks filed for the years 1994 through 2011. Controlling for factors including size and industry—bigger or highly regulated companies naturally file longer 10-Ks—they looked at how well the stock market appeared to read the performance of companies with lengthy filings.

Answer: Not so well. In the weeks after filing, shares of those with longer reports tended to be more volatile than those favoring brevity.

Somewhere along the line, disclosure became synonymous with transparency. Particularly in eyes of many governance mavens. Perhaps that’s because, since 1933 at least, the ability to compel disclosure has been the main tool in the federal regulatory tool chest. When you have a hammer…

I often introduce the Enron case with its 10-K from the year before the firm’s implosion. It’s difficult to go through that tome, including the volume of data on its infamous Special Purpose Entities, and claim that insufficient disclosure was the culprit. Their management accurately, if literally, conveyed the complexity of its operations.

This new study begins to explain how disclosure is not the same thing as transparency, and why the “more is better” instinct may be leading us astray.

Posted by Marc Hodak on February 10, 2014 under Governance, Self-promotion |

I am excited to announce a new online resource for corporate professionals interested in ethics, governance, and related business issues: EthicalSystems.org. The idea behind Ethical Systems is to provide academic rigor to work on improving the ethical behavior of organizations.

This site is the brainchild of Jonathan Haidt, the brilliant NYU researcher and author of the bestselling “The Righteous Mind.” Jonathan was grappling with the fact that ethical behavior has, thus far, been profoundly resistant to improvement via formal training. So he corralled some world-class researchers* to develop individual pages devoted to specific topics such as Cheating, Corruption, Leadership, and (of course) Corporate Governance.

Take a look at it, and feel free to send comments or ideas to the researchers managing the pages. This is intended to be a collaborative effort not just among academics, but between academia and the businesses this initiative is intended to serve.

* As the person maintaining the Corporate Governance page, I am definitely the least distinguished of this group

Posted by Marc Hodak on December 15, 2013 under Governance, Regulation without regulators |

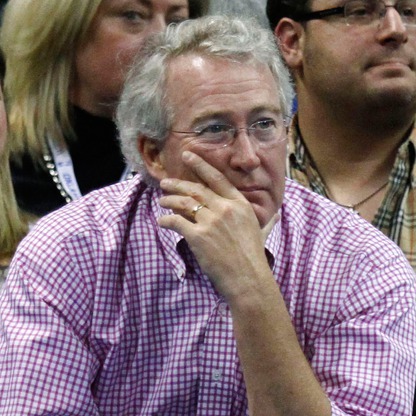

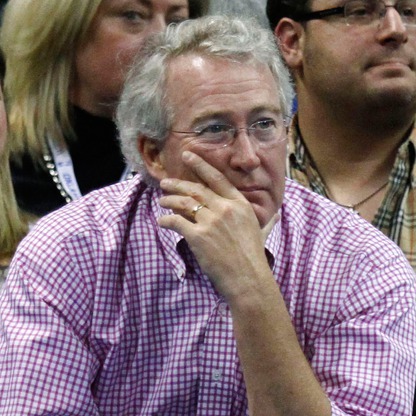

Aubrey McClendon, former CEO of Chesapeake Energy Corp. (which, as far as I know had nothing to do with the bay near where I grew up), is pulling in billions in new capital via his American Energy Capital Partners LP. The partnership will have some unusual governance features:

American Energy Capital also disclosed a range of potential conflicts of interest. The sponsors can favor their own interests over those of investors. In addition, the partnership may invest in oil and gas properties where Mr. McClendon’s firm has interests. Mr. McClendon’s management group won’t owe a fiduciary duty to the partnership, according to its registration statement.

Now, would I buy into a partnership with such conflicts? Probably not.

Would I prohibit anyone else from buying into such conflicts? Definitely not.

This partnership may or may not prove to be as good a deal for its investors as Chesapeake was for theirs. I would leave it to others to discern the bet they are making. But I would not prevent them from making their bet. And once they buy into this partnership, I would not favor the government forcing a change to the rules they bought into for the sake of “good governance.”

If all this makes sense to you, and I know it won’t to everyone, then you should be disturbed when public companies are forced to reform their governance through a federalization of corporate rules that supersede their charters. We can’t know that such “reform” will enhance the returns of outside shareholders; no governance regulation adopted by Congress over the last couple of decades had any empirical support that it would actually help shareholders, either before it was adopted or after it was implemented. But we do know that the reforms will cost every company in three ways:

(1) The Compliance CAFE (Corporate Advisers Full Employment)

(2) The occasional cost of sub-optimal decisions because of decision-making constraints created by the rules, i.e., unintended consequences

(3) The costs of lawsuits alleging a breach of the rules, regardless of their actual breach, because it is often less expensive to settle these suits than to fight them and win, i.e., the Plaintiff Lawyer’s Tax

This is not to say that we shouldn’t have any rules with regards to corporate governance. But I would suggest that the rules agreed upon by the original parties to the transaction should be given much more of the benefit of the doubt than those dreamed up by a meddling Congress. Even bad bets contribute to our progress.

Posted by Marc Hodak on December 2, 2013 under Governance, Politics |

New SEC Chairpersons tend to bring along new priorities. Mary Shapiro, former FINRA regulator, brought a strong regulatory agenda. Mary Jo White, former United States Attorney, is bringing a strong prosecutorial agenda. This shift in priorities appears to have manifested itself in a new Rule List that, at least for now, drops the push for disclosure of corporate political contributions. The pro-regulatory crowd is not going to be happy.

Corporate political spending has been a hot topic since Citizens United in 2010. This ruling gave corporations and unions the ability to spend without limit on political ads, as long as they did not directly contribute to a candidate’s campaign. The people pushing hardest for corporate disclosure of such spending have—no surprise—been those most opposed the policies that corporations are most likely to promote, e.g., less regulation, lower taxes, and reduced trade barriers.

Of course, these political opponents aren’t going to argue that corporate America should not spend money on politics just because they oppose their policies. Americans won’t accept selective application of First Amendment rights. Instead, these opponents have taken a subtler tack, arguing that good governance requires greater transparency.

Read more of this article »

Posted by Marc Hodak on November 11, 2013 under Executive compensation, Governance, Invisible trade-offs, Pay for performance |

Pay for performance seems like such a simple idea, and easy to accept as a basis for judging executive compensation. So why does it continue to create such discussion and controversy? Well, consider the following grid:

The key distinction is managerial performance versus company performance. An easy way to understand this distinction is to consider a gold mining company when the gold price has dropped significantly, but our company’s profits and stock price have dropped less than half of anyone else’s in our sector due to extraordinary management. It’s easy to see in such an example that our management has done great, but our shareholders have done poorly. Should such managers get a bonus?

When management and shareholder performance are strong, as in the upper right quadrant, the answer is obvious. When management and shareholder performance are weak, as in the lower left quadrant, the answer is obvious.

But what do we do when our gold company finds itself in the upper left quadrant? If we pay a bonus for this situation, we are open to the accusation of pay without performance by our investors. Our investors might bother to look at relative performance, in which case they might forgive bonus payments up to a point. But there is no way outside investors can gauge what the board can, i.e., that our managers actually did a great job given their situation, and that denying them a bonus may entail a significant risk of losing them to other firms that promise to compensate them for being great managers.

Paying a bonus for lower right quadrant performance is equally problematic. Most shareholders will let you get away with it because they are feeling flush. But those that don’t are on firmer ground in saying it would be pay without performance, that management was simply in the right place at the right time. In this situation, the downside to not paying a bonus is a little more subtle. If we deny managers a bonus for poor relative performance in the face of good absolute performance, then we MUST be willing to pay them bonuses for good relative performance even when the company suffers poor absolute performance. In other words, boards justifiably refusing to pay bonuses when they are in the lower right quadrant will eventually they find themselves in the upper left quadrant having to pay bonuses, or risk almost certain loss of their best managers. And we already highlighted the difficulty in adhering to a policy of consistently paying for relative, as opposed to absolute performance.

True to their pragmatic form, many boards resolve this dilemma by paying for both absolute and relative performance. This makes the plans more complicated, and does not completely eliminate at least some criticism of pay without performance, but it at least attempts a workable compromise. Fortunately, ISS (pdf) and Glass-Lewis provide a least some cover for pay for relative performance, but that only gets you so far.

What would you do?

Posted by Marc Hodak on October 30, 2013 under Executive compensation, Governance, History, Unintended consequences |

The last time that CEOs were routinely kept awake at night was during the merger wave of the mid-1960s.

The frothy ’50s turned out to be high tide for American industrial dominance, a time when we were rebuilding the world after a devastating war. CEOs had it pretty cozy then. As the tide began to recede, investors began to notice the accumulated waste made possible by a decade of easy growth. A few of them saw advantage in taking over the worst governed companies in order to restructure them. At that time, they could do so without warning, which is what made this environment so frightening to CEOs. Imagine never knowing when you might get a phone call telling you that you are out. This is like going trick-or-treating and fearing the “tricks” all year long.

Corporate executives of that period had grown up in a world where being a leader meant getting along with everybody, and knowing how to use the corporate treasury to buy allegiances, including labor, business partners, and politicians. These new people on the scene—called “raiders”—were after the whole treasury, in part to prevent it from being used as the CEO’s relationship kitty. The governance mechanisms of the day gave them access to it by simply taking advantage of the stock being cheap after years of neglect.

Worried incumbent CEOs reacted by contacting their congressmen, who also knew a thing or two about incumbency. This unholy partnership took control of the narrative. Instead of investors identifying bloated companies in order to restructure them and return excess funds to remaining shareholders, the incumbents claimed that:

“In recent years we have seen proud old companies reduced to corporate shells after white-collar pirates have seized control with funds from sources which are unknown in many cases, then sold or traded away the best assets, later to split up most of the loot among themselves.” (Sen. Harrison Williams, 1965)

The media bought it. The legend of the “corporate raider” was born. The off-hand mention of “unknown” funding sources added a hint of nefariousness. (Who did they think provided the funds? Why did it matter?) The media didn’t consider that any mechanism that made the sum of the parts worth so much more than the whole might actually be socially useful. Instead, they played on the conservative discomfort of seeing old line, industrial firms disappearing at the hands of destabilizing (and generally non-WASP) upstarts, and the liberal discomfort of “money men” involved in unregulated financial activities.

Thus, in the fall of 1968, Congress passed the Williams Act. This law prevented investors from making a tender offer for shares without giving incumbent boards and management a chance to “present their case” for continued control of the company—as if they hadn’t already had years to make their case.

Now comes the weird part. Read more of this article »

Posted by Marc Hodak on October 14, 2013 under Governance, History |

"More lucky than good"

Consider that you are on the board of a company of adventurers, and one of your captains, Chris Columbus, comes to you with a project.

“The learned people all think that the world is flat. Our R&D indicates that the world is round. If you fund our voyage, we will be able to obtain the wealth of the Indies spice trade via a shorter route from the west instead of from the east.”

One director chimes in, “But Chris, all the experts say that the world is flat, and that the western route is terra incognito. Why don’t you think you won’t simply fall off the edge of the world?”

Chris replies: “The experts are wrong. Here is my data. Fund me, and glory will be ours.”

According to the story we were taught in school, Columbus was not able to get money from the usual channels that might fund a sea voyage, and it was the bold bet by Queen Isabella that launched him toward America and legend. In this story, Isabella was the perspicacious investor behind a brilliant, if misunderstood, CEO. Her good bet paid off in the bounty of a New World, and all those investors who wouldn’t back Columbus were fools who lost out.

What really happened looked like this.

Chris Columbus tells the board: “The learned people say that the world is a very large sphere, about 20,000 to 30,000 miles around. Our R&D indicates that the world is only about a third of that size around, meaning we can more easily obtain the wealth of the Indies spice trade via a shorter route from the west instead of from the east.”

One director chimes in, “But Chris, if the experts are just a little more correct than you are, you will simply run out of supplies on your voyage, and die.”

Chris replies: “The experts are wrong. Here is my data. Fund me, and glory will be ours.”

The real Columbus was not able to convince anyone with any learning that a western route to the Indies was shorter than the eastern route that was already established. He was able to convince a Queen with more wealth than knowledge. She enabled him to set out on what, by all rights, would have been a voyage to oblivion. Just as his supplies were running out, he stumbled upon the New World.

Boards of directors have basically one job—to make good bets and avoid bad ones with their shareholders’ funds. This is a difficult job under the best of circumstances, which necessarily includes incomplete information and a limited range of capabilities, including the normal biases and dynamics of even well functioning groups. On top of that, they must deal with the bane of businessmen everywhere—luck.

In the mythical Columbus story, the adventurer and the Queen made a good bet, and won. In the real story, they made a bad bet and won. The problem for directors is that the world only sees results; it cannot see the quality of the bets that led to them. Columbus’s bad bet was redeemed by an accident of incredible fortune. The Queen appeared to disprove the adage about a fool and her money, and the investors that wisely turned down Columbus’s bet were ridiculed for a missed opportunity.

Obviously, each of us would prefer a board that makes winning bets rather than losing ones on our behalf. But no one can dictate the outcomes of our bets. The only thing we control is the quality of our bets. By definition, good bets are more likely to pay out than bad ones. A board that effectively distinguishes these things should be more effective. But they can still lose. The world isn’t fair.

I have seen well-meaning boards make reasonable bets and end up lambasted on the front page of the Wall Street Journal for looking foolish. I have seen boards that were in over their heads nonetheless feted when the wind found their backs. The business world looks very different to those of us who are on the inside versus those reading the stories. We know that the world is not fair, and deal accordingly.

My Columbus Day message is this: We should always strive to be good, and hope we are also lucky. In life, if not always in business, we are generally blessed with many chances to succeed or fail. Over time, good luck and bad will tend to even out, and the quality of our decisions should show through. Even then, though, luck has a say.

Posted by Marc Hodak on October 6, 2013 under Governance, Patterns without intention |

"The public be dammed" (sic)

Churchill famously remarked that “democracy is the worst form of government, except for all the others.” This is a great lead-in to distinguishing democracy as a collective decision making process that is useful for some purposes, but not for others. For instance, democracy is not well suited as a decision mechanism for running a company. You haven’t heard of a company run as a democracy? There’s a reason for that.

In fact, when we look at the governance spectrum for companies as ranging from democracy (e.g., shareholder-run firms) to oligarchies (e.g., board-run firms) to dictatorships (e.g., “imperial CEOs”), it is worth noting that the overwhelming percentage of wealth created in this country was by imperial CEOs, folks like Ford, Disney, and Jobs. Imperial CEOs also fail, of course, sometimes spectacularly. When they do, corporate critics pounce and say, “See? An imperial CEO runs the company into the ground! If there had been more checks and balances, more shareholder involvement or awareness, this would never have happened.” It is very hard to argue against that. Except that no company run as a shareholder democracy has ever generated enough wealth to even be worthy of a scandal.

Today, we are hearing the drumbeat about the evils of “shareholder value.” Here is one drummer, Lynn Stout, beating on shareholder value:

The idea that corporations should be managed to maximize shareholder value has led over the past two decades to dramatic shifts in U.S. corporate law and practice. Executive compensation rules, governance practices, and federal securities laws, have all been “reformed” to give shareholders more influence over boards and to make managers more attentive to share price. The results are disappointing at best. Shareholders are suffering their worst investment returns since the Great Depression; the population of publicly-listed companies has declined by 40%; and the life expectancy of Fortune 500 firms has plunged from 75 years in the early 20th century to only 15 years today.

Stout, like many other corporate critics, is conflating the movement for shareholder value that gathered steam in the early 1980s with the movement toward shareholder democracy that gathered steam in the early 1990s.

These are different things.

Read more of this article »

Posted by Marc Hodak on July 28, 2013 under Executive compensation, Governance, Invisible trade-offs |

I am often dismayed by the popular response to “dollar-a-year CEOs.” These bosses give the media a feel-good story: You don’t have to be greedy. You can be a not-so-fat-cat!

Apparently it’s not just John Q. Public–several times removed from the real world of compensation governance–that buys this stuff. Just last week, a tech company CEO in a WSJ “expert” panel praised the dollar-a-year standard, and the swell guys and gals who adopt it, saying that all CEOs should be so virtuous.

These are people that are out to change the world. They are owners. They are builders. They bleed for their company and what they are creating. It’s not about the money.

His examples were Steve Jobs, Larry Ellison, Mark Zuckerburg, Meg Whitman, Larry Page. Do you see a pattern (besides all the money)?

Read more of this article »