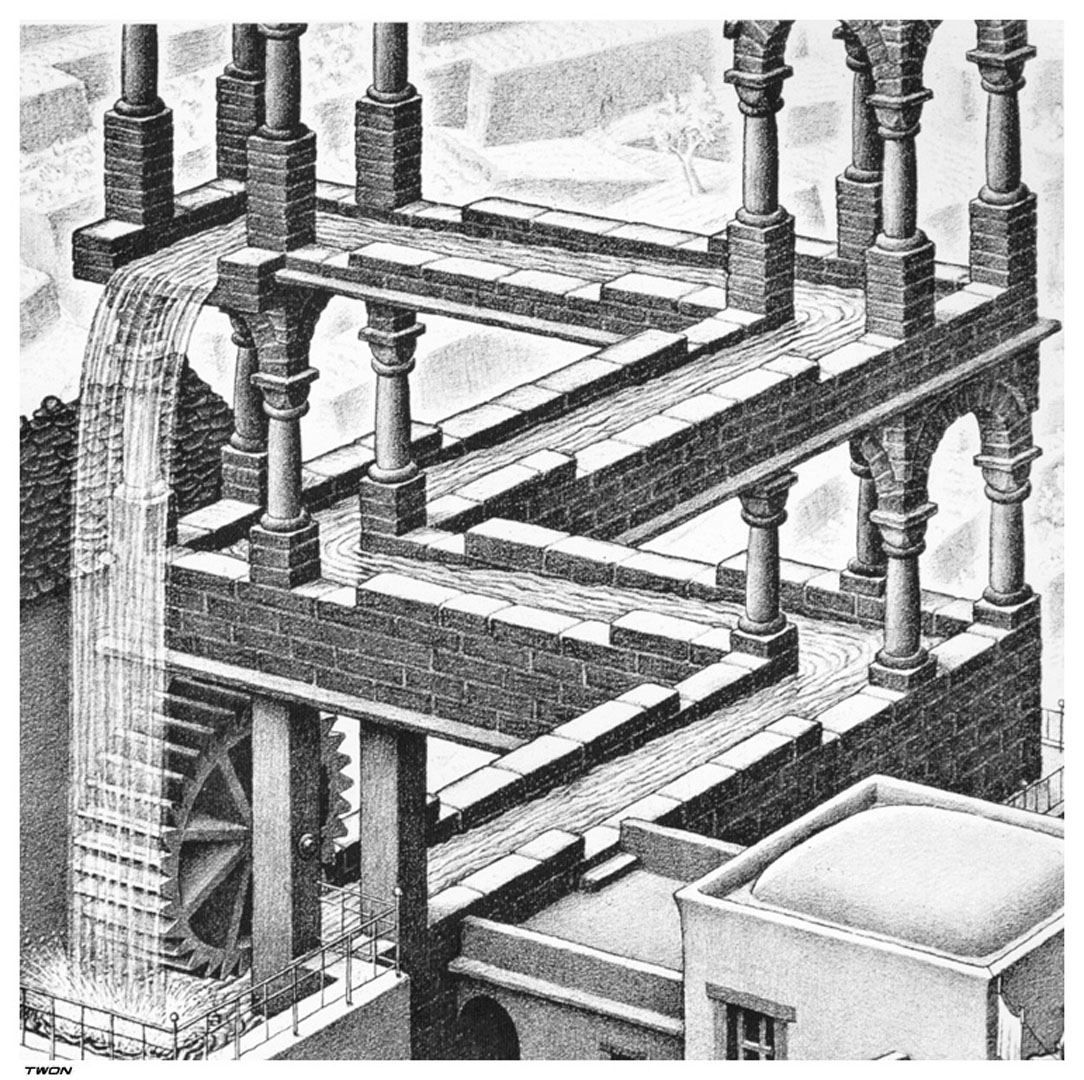

Bonuses: Economic logic leads to a “paradox”

Paradox: a statement that is seemingly contradictory or opposed to common sense and yet is perhaps true

The media in Europe are starting to call skyrocketing banker salaries across Europe the “bonus paradox.”

The EU limit on bonuses to 100 percent of salary (or 200% with shareholder approval) is ushering a paradoxical parade of unintended consequences. But just because consequences are unintended doesn’t mean they are unpredictable.

The economic ignoranti fully expected overall banker pay to be clipped by the EU measure. José Manuel Barroso, president of the European Commission said, “This is a question of fairness.” So, there it is.

Except that banks are not going to lose their most mobile workers for insufficient pay. Bankers, you may not be surprised, are good with money; they know what they are worth, and they are confident about it. They would actually prefer to be paid for performance, and are unhappy about the higher mix of fixed-to-variable compensation that effectively caps their upside, even if it leaves them more-or-less whole in expected value terms. But they will not accept less than what the guy down the street, or in New York or Hong Kong, will pay them.

The more sophisticated proponents of this law would say that it wasn’t the level of pay they were actually after, but the structure of pay in the form of bonuses that encouraged undue risk taking. They’re OK with the new compensation mix, and feel it will reduce financial risk. They are wrong, too. Yes, it is theoretically possible that perverse incentives can lead to undue risk-taking, and there was certainly some of that going on in the lead-up to the financial crisis. But there is zero evidence that bonus structures that have been around for decades, and whose incentive effect have been understood and refined and overseen for decades, would all of a sudden in the middle of the aughts suddenly be the cause of a global catastrophe. If you want to properly diagnose a cause, look at what has changed, not at what was always there. If that logic doesn’t persuade, then perhaps empirical evidence would, and the evidence denies the hypothesis. If logic and empiricism don’t sway you…then you are fully qualified to run for the legislature.

Unfortunately we are not done with paradoxes and unintended consequences. The whole point of this law, along with its companion rule on capital buffers, was to reduce financial risk faced by banks. Yes, financial risk may be reduced by capital buffers. But it is heightened by fixed costs. This law replaced a large portion of variable costs with fixed costs, more than negating the effect of capital buffers. When the downturn comes as it inevitably must no matter what the capital buffers, banks will have less flexibility to deal with it.

Paradoxical? Sure. Unintended? Certainly.

But totally predictable.

Add A Comment