The other kind of shareholder vote

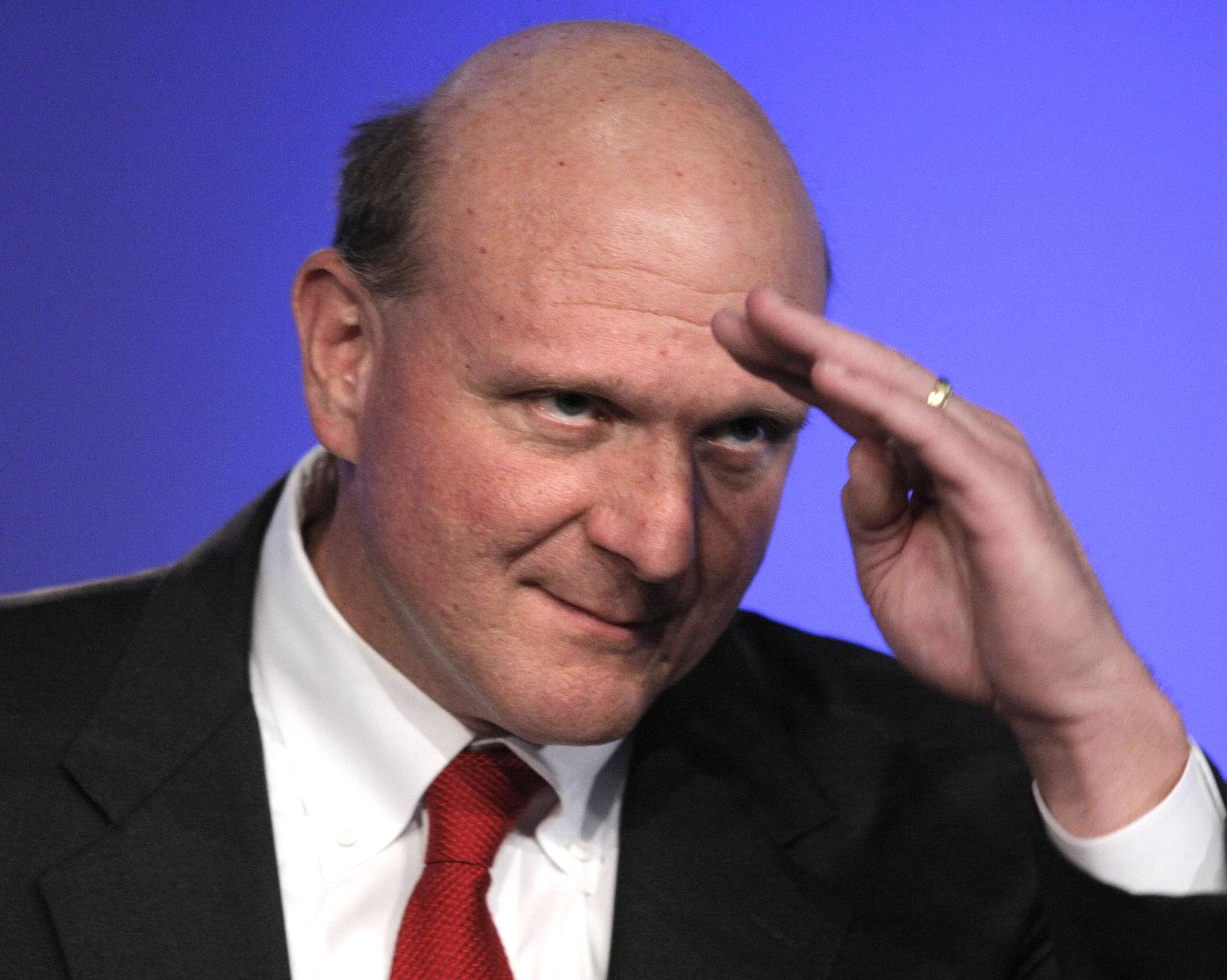

The other Steve

Steve Ballmer announced his resignation, and Microsoft’s stock price shot up seven percent. Ouch.

That investor verdict is far more damning than anything shareholders could have conveyed through a proxy vote. It tell us pretty directly what the market thinks about Ballmer or, more specifically Ballmer’s leadership relative to anyone that Microsoft is likely to hire as his replacement.

One way to read this reaction is that Ballmer has been a roughly $19 billion drag on his company. This deficiency might have been inferred by the fact that Microsoft’s stock has gone exactly nowhere* in the decade that Ballmer has been CEO, significantly underperforming the Nasdaq, not to mention its closest competitors Oracle, Google, and especially Apple. I’m sure Steve Ballmer is in for many unflattering comparisons to Steve Jobs in the upcoming weeks.

I’m not here to bury Ballmer, or to praise him, but to highlight how this coda of his tenure reflects on the value of a “typical” CEO. I often hear how a CEO doesn’t do it alone–he or she is part of a team. I often hear people questioning whether the average CEO is worth the $15M to $20M per year that they get paid, or whether any CEO “needs” the $100 million they may have gotten paid in a year of outstanding performance. I have answered these questions in prior blog posts, so I will encapsulate them here.

1) Sure, a CEO is just one person on a team, but the CEO ultimately selects and manages that team, amplifying or cancelling their talents. His or her marginal contribution is still very large.

2) Ballmer illustrates that a CEO may be worth much less than $20 million per year. Other CEOs, like Jobs (OK, I’m starting the comparisons), are worth much more than $20 million per year. The stock reaction when Jobs announced his resignation was a drop of about $10 billion, although his announcement was not entirely unexpected. So, how plausible is it that the average CEO is worth about $20 million per year? More plausible than $2 million or $200,000 per year, although the value variance around that average is obviously very high.

3) No person “needs” $20 million or $100 million or any such astronomical sum. But nobody this side of the Soviet Union gets paid according to their need. If things are working right, they get paid what they’re worth. This correspondence is never perfect, but we haven’t yet found a better way.

By the way, Ballmer earned about $1.3 million per year in salary and bonus as CEO of Microsoft, much less than a typical Fortune 500 CEO, but not out of line for someone whose personal net worth likely went up and down about $100 million a day due to his MSFT stock holdings which, as mentioned earlier, didn’t net him anything more than he started with over his tenure. In other words, alignment wasn’t an issue for Ballmer. Maybe he just decided he didn’t need any more? Maybe he wasn’t greedy enough?

* I’m being generous here by tagging the stock’s fall in his first year as an artifact of the dot-com bust.

Add A Comment