The shareholders spoke, and they didn’t like what they heard

Those who have followed the Dupont/Trian contest know that the shareholders voted (barely) to retain the incumbent board. But two other, fascinating pieces of information are apparent from the aftermath of that vote regarding the investors’ reaction:

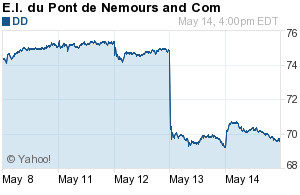

1. The market was surprised

2. The market was disappointed

A seven percent drop in the stock price is huge. Shareholders were clearly invested, so to speak, in seeing Trian win, even as they voted them down. So, while shareholders-as-voters accepted CEO Ellen Kullman’s explanation that Nelson Peltz does not know as well as she what is best for their company, shareholders-as-traders said, “Whoa, that was a terrible decision!” We assume that, being the same people, each making their judgments based on their individual, independent estimation about the future prospects of the company, and with the “wisdom of crowds” sorting out their discordant judgments into a useful, single verdict, we should see less schizoid outcomes.

Alas, this “crowd” effect works via very different mechanisms in proxy voting versus in market pricing. So, which result should management heed? Read more of this article »