I love Tea Girl

I just hope she isn’t in some gulag after this:

More here.

HT: an uncredited reasonoid

Perverse Incentives Are Endemic (TM)

I just hope she isn’t in some gulag after this:

More here.

HT: an uncredited reasonoid

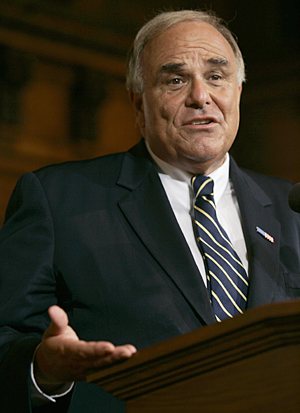

Governor Ed Rendell of Pennsylvania, that is. We’ve never hung out, but the Governor strikes me as a decent guy. He’s caring, intelligent, and has a sense of humor. His economic literacy, I’m not so sure about that.

Governor Rendell devoted his entire talk last night discussing our infrastructure. He noted that Pennsylvania and the rest of the nation are suffering horribly from deferred maintenance. He had the numbers to prove it. Good enough. But, there was one point he repeatedly brought up:

The states can’t do it alone. The states supply 75 percent of the spending on infrastructure, but it’s not enough. Ours is the only federal government among the wealthy nations that does so little for its infrastructure. The federal government has to be part of the solution.

So, I asked him:

Governor, isn’t that saying that the taxpayers of Pennsylvania should pay for infrastructure in Alaska, and taxpayers of Alaska should be paying for infrastructure in Pennsylvania? That bargain hasn’t worked well for Pennsylvanians in the past.

It was two questions, really. The first asked why he supposed there would be more money from the taxpayers collectively than there is from the sum of them individually. The second asked what benefit there was by taking the same pool of money and funneling it through Washington, D.C..

His answer to the first half would have been shocking if it didn’t come from a politician: “The federal government can always find the money.” That’s right, he literally said “find.” The money is out there, the government simply needs to “find” it. Nobody in the room who heard this non-answer seemed surprised. His answer to the second half was barely better: “We’d need to insure accountability in the distribution of such funds via a panel of experts.” We know how that works out.

In Jared Diamond’s excellent book Guns, Germs, and Steel poses a question via the mouth of a Papuan native: “Why do you have so much cargo?”

“Cargo” is a native word for ‘stuff,’ as in the kinds of goods commonly produced by an advanced society. Every primitive culture that has come into contact with an advanced civilization for the first time has shared an understandable awe at the explorer’s (or invader’s) ‘cargo’–from their explosive armaments down to their metal shoe buckles.

Now, a civilized person might assume that natives faced with ‘cargo’ might try to understand how it was made so they might begin to build approximations of it. But that would reflect the civilized person’s naivete. In fact, primitive people commonly endow things with a mystical property that goes beyond its form or function. For them, everything is guided by a higher spirit, a spirit may send the cargo their way versus toward someone else.

Down that mystical path, natives will begin engaging their existing theories about what moves the spirits, and begin to exhibit what, to us, looks like strange behavior to persuade the spirits to drive cargo their way. This is called a cargo cult.

Civilized people look upon cargo cults with a sense of wonder and amusement. We shake out heads at shirtless people dancing and praying to their version of Gaia, as if that might somehow make a washing machine appear. Civilized people would never do that.

On our way back from dropping our big guy off at college, we looked at schools with our little guy. (We call him the “little guy” although he’s now the biggest member of the family.) We looked at a cross section of schools–big, small, public, private, urban, rural, etc. His verdict was in favor of bigger, small-town campuses. UVA scored well on these criteria.

We also figured out on this trip that New York kids apply in out-sized numbers to schools in the mid-Atlantic. Why? The obvious answer is that there’s lots of us. The more complete answer, especially when faced with paying private school rates for public schools (a.k.a., out-of-state tuition), is that many state schools (UVA, UNC, Maryland, etc.) are pretty good. SUNY, on the other hand, is among the worst systems in the country. New York state should be ashamed of itself, but then I know what New York politics is like, and shame is not part of the equation.

We also got some more insight into how the average kid chooses a college, even though this is our second student. One has in-school and on-line resources to help determine the appropriate criteria for choosing. One has publicly available judgments of various institutions along the dimensions of those criteria. And stuff. In the end, it seems to come down to reputation and physical attractiveness. And, of course, by that little thing we know of as admissions. And maybe who gives you money to offset those outrageous tuitions. (College or a new house?)

Most people are against earmarks, it seems, except those who dish them out.

The political logic of earmarks is impeccable. If you’re a Congressman or Senator, there’s this big pot of money on the table. If you don’t reach into it, others will, and will leave you with nothing. Do you want to be Congressman Can’t Bring Home the Bacon? Individually, congressmen may largely agree on the idea of getting rid of pork barrel spending. It would actually make their jobs easier, more ennobling even, to focus on the bigger issues of state than who should get what from the public trough. But the people with the power to change the system are the ones who benefit the most from it. They have the most control over the pork. They are the most adept at using that pork to maintain their power. They indeed grew up in this system of power for money, and frankly wouldn’t know what to do if it were drastically changed. So, earmarks are ingrained in our politics.

The economic logic against earmarks is just as impeccable. When a congress-critter proclaims that they secured $500,000 for a new Teapot Museum, their constituents may be thinking, “Do we really need this?” But what many of them are also asking is, “How much money did I send to Washington? If I’m getting this little part of it back, why didn’t they just let me keep it and spend it?” In other words, there is probably little to be gained from my congressman spending my tax dollars on some private benefit for me. I’m perfectly capable of paying museum admission, if I’m interested in patronizing. If I’m not, then why I am I being made to pay for it?

Let’s not even get into how constitutionally or morally suspect the earmarks process is.

Some people are fooled into thinking that someone else is paying for the goodies that our congressmen “bring home.” But any reasonably educated person (as opposed to overeducated, perhaps) knows that it’s a little like the person who stole your silverware coming back for a visit bearing a nice gift of a serving fork. Gee, thanks.

This entry begins to answer a very relevant, but rarely asked question in the debate on immigration: how much is immigration worth to relatively unskilled immigrants? In other words, if you were relatively poor living outside of the U.S., how much would it be worth to become one of the poor inside the U.S.? The answer appears to be a small but significant risk to your life plus $4,000.

That, plus the mindless persecution of native Americans from England, France, Germany, etc. who don’t think we have any room for more. Plus the plans of idiot politicians who have no idea what they’re up against in trying to stem this tide, and are willing to betray the liberties of those who live here legally to try to stop those that don’t.

Now, if poor people are willing to pay thousands of dollars to get across our border illegally, how much can we increase the cost per person with all the measures that the most outrageous wall-builders are planning to implement? Will that increase their costs significantly? At all?

“I hope the arrest can ease the minds of some in the community,” District Attorney Jim Woodall said.

I truly hope they found her killers, and that they pay dearly for their crime. But I’d just as soon get this kid a decent attorney to keep the system down there honest. One thing I learned about Durham police and ATM evidence is to reserve judgment.

I’m reminded by one hilarious, braided commenter: “If this is how the DA treated three white Duke lacrosse players, I don’t even know what he woulda done to my black ass.”

Update: One of the suspects in Eve Carson’s murder has now also been charged with the January murder of Duke student Abhijit Mahato. He’s the second person who has been charged with that murder. Two people charged with the same murder, you say? Yea. That’s what I’m wondering.

So, Eliot Spitzer has had to publicly apologize for having sex with someone who wasn’t his wife. For money, that is. The pandemonium has begun, because everyone knows that sex-money-politics is the very best headline-grabbing mix.

Like most places, johns are rarely prosecuted in New York, according to Michael Bachner, a former prosecutor in the Manhattan District Attorney’s Office:

To the extent Mr. Spitzer is charged it would likely be under the Mann Act, which prohibits transportation of people across state lines with the intent to commit prostitution.But “the Mann Act really was designed more towards those who get someone to travel against their will,” Mr. Bachner said. “If Spitzer gets indicted, it would seem to me he would be indicted based on who he is rather than what he’s done.

Oh noes. We wouldn’t want to selectively prosecute someone just for who he is rather than what he’s done. Why, that would be so unfair, so political. Mr. Bachner goes on to say:

Those who frequent prostitutes are very, very rarely the subjects of a federal prosecution when clearly it’s commercial and consensual.”

Why, that would be like seeking criminal sanctions for what are generally treated as civil cases.

As for possible state charges, he said “customers are rarely prosecuted in the state” and charges that are brought are typically disposed of with a plea to disorderly conduct, “which is akin to a traffic ticket,”

I, for one, would like to go on the record opposing the politicization of the state’s attorney’s office by hounding Mr. Spitzer in any such fashion. I think that would be a dangerous road to travel. It would create a power subject to horrible abuse.

Here is what I’d like to see instead.

Henry Waxman, Chairman of the House Oversight and Government Reform Committee, held hearings yesterday on executive compensation. The Wall Street Journal predicted:

It should make for good political theater. For added effect, Mr. Waxman has invited testimony from corporate-governance experts and Brenda Lawrence, the mayor of Southfield, Mich., a middle-class community that has been affected by the housing crisis.

(HT: Larry Ribstein)

Here are my qualms about Congress trying to substitute their judgment for that of directors on this issue:

1) Their analysis is post-hoc. The competition for talent in the executive suite is fierce–something Henry Waxman doesn’t really believe. The competition for returns in the corporate market is extremely fierce, something Henry Waxman doesn’t have a clue about. About ten percent of executives that were thought highly competent when they were hired will end up in the bottom ten percent of corporate returns, even on a sector-by-sector basis. “Why did the board pay these people so much money when they plainly were such poor CEOs?”

2) Even post-hoc, Congress is incapable of distinguishing perverse incentives from decent ones. It’s not that they’re stupid. I have quizzed institutional shareholders, securities analysts, corporate officers, even other compensation consultants on the incentive effects of certain compensation structures, and they often come to the wrong conclusion. “You mean that regular grants of restricted stock actually create an incentive to tank the stock price?” Could happen. I’m skeptical that our national Chamber of Unintended Consequences will come to the right conclusions.

3) I pity Compensation Committee members. Yea, there are a few who are careless, maybe even negligent. I’ve read about them, and can jump to conclusions as fast as any reader. And Nell is right that most compensation committee members don’t quite know what they’re doing in structuring packages, but that’s not their fault. We don’t generally hire incentive experts to the board, and their fiduciary responsibility demands that they apply incentive mechanisms to their packages, and incentives are tricky (see 2). Nevertheless, the directors I’ve personally worked with, to a man (or woman), have been highly conscientious and, if anything, wary of overpaying their CEO to the point of occasionally hurting their chances of retaining a very good person.

Personally, I believe that the answers to the ‘problem’ to exec comp are far more subtle than a congress-critter can manage.

Link here on “where does this committee the authority to investigate stuff like this?”

Toll Brothers has somehow flushed a perfectly good bonus plan down the toilet.

Their old bonus plan gave the CEO a fixed 2.9 share of his company’s profit gains. There was no cap on the bonus, which presumably meant no cap on their performance. And their performance was good. In the good years, their CEO made big bucks. So did the shareholders, including the largest shareholder, the CEO.

The new bonus plan is based on undisclosed “varied” criteria. In my experience, this is pretty close to saying “discretionary.” Mr. Toll also continues to get 2 percent of the profit, so there is now marginally less emphasis on profitability, and more on other “varied” stuff. And his new plan is capped at $25 million. Two things puzzle me about this cap: it’s arbitrarily high, so it won’t likely be a practical limit, and it still manages to convey that we will cap performance when the wind is really to our back. This is almost the perfect way to convey the message that we will provide a token sop to our investors that doesn’t really help them.

What I don’t get is why Mr. Toll would go to the trouble of undermining a perfectly good bonus system for a few million more dollars. The man owns 29 million shares. It’s not like this extra $6 million he would have earned under the new plan would make up for the nearly $300 million he lost as a shareholder from the decline in his stock price. He can make this bonus amount with a one percent increase in his stock price.

Then, KB Homes, with the same, nearly flawless bonus plan, objective and profit-based, decides to override the market’s short-term verdict with a “discretionary” bonus of $6 million (coincidence?). Their explanation?

Otherwise he wouldn’t have received KB’s standard “annual incentive” for the top job, which is tied to profits under the builder’s current plan.

“Standard annual incentive?” What the hell is that? The bonus amount you get paid for not earning your bonus?

“This is the kind of stuff that makes us crazy,” says Richard Metcalf, director of public affairs at the Laborers International Union of North America, whose pension funds own stakes in both Toll and KB. “What kind of board of directors gives a $6 million bonus when the company’s stock falls 60%?”

It drives me crazy too. And it’s the kind of thing that invites Henry Waxman to pull CEOs into his Star Chamber, and the IRS to do stuff like this.