The shareholders spoke, and they didn’t like what they heard

Those who have followed the Dupont/Trian contest know that the shareholders voted (barely) to retain the incumbent board. But two other, fascinating pieces of information are apparent from the aftermath of that vote regarding the investors’ reaction:

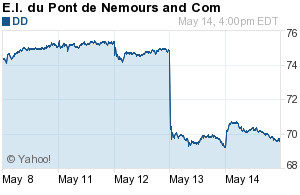

1. The market was surprised

2. The market was disappointed

A seven percent drop in the stock price is huge. Shareholders were clearly invested, so to speak, in seeing Trian win, even as they voted them down. So, while shareholders-as-voters accepted CEO Ellen Kullman’s explanation that Nelson Peltz does not know as well as she what is best for their company, shareholders-as-traders said, “Whoa, that was a terrible decision!” We assume that, being the same people, each making their judgments based on their individual, independent estimation about the future prospects of the company, and with the “wisdom of crowds” sorting out their discordant judgments into a useful, single verdict, we should see less schizoid outcomes.

Alas, this “crowd” effect works via very different mechanisms in proxy voting versus in market pricing. So, which result should management heed?Proxy voting is like a caucus, done in a public forum, and—in certain cases—allowing for the possibility of information cascades that can undermine independent judgment and, hence, ‘crowd wisdom’. Market pricing is strictly between a person and his or her computer screen via a double-auction mechanism. And non-shareholders get a say in pricing, too; thousands of people merely thinking of buying the stock, only now at a lower price because (for example) of the way that current shareholders vote their proxies is how prices can dramatically swing without a single share trading hands.

When it comes to prediction and value, the market mechanism is generally far superior to voting. In Dupont’s case, “the market” clearly, ironically, missed how shareholders were going to vote, and the shareholders clearly, ironically, voted in a manner that destroyed significant value, at least in the short term. We sometimes see that happening with proxy votes on governance structure, but in such cases voting is tainted by the influence of proxy advisors, both by undermining independence of judgment and by providing bad advice.

In this case, though, the proxy advisors turned out to be right in recommending in favor of Trian nominees. This may speak to how much better they are in analyzing special situations than in applying one-size-fits-all standards. Or it might just be saying something about broken clocks. In any case, as Kullman and her team celebrate their victory, they would do well to heed what the market is telling them more than what their shareholders are telling them. The market verdict was much less ambiguous.

Bernard S. Sharfman said,

Thankfully, proxy contests initiated by activist hedge funds don’t happen that often. But when they do, shareholders need to realize that they should be supporting the Board unless they find the Board to be lacking in independence or incompetent. I make this point in Part V (new) of my recent article, “Activist Hedge Funds in a World of Board Independence: Creators or Destroyers of Long-Term Value?” (version dated May 14, 2015; forthcoming, Columbia Business Law Review).

Bernard S. Sharfman said,

The article can be found downloaded at http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2576408

Anon said,

I am not sure I understand your claim that share prices are the result of a double auction. Market makers set a bid ask spread and either agree to a negotiated price within that spread or a buyer (seller) crosses the spread and accepts the price on offer (bid). How is that a double auction? Also, Dupont is traded on the NYSE not the Nasdaq and your link was to the Nasdaq. At the NYSE a specialist is a Walrasian auctioneer who establishes a market clearing price based on his/her assessment of supply and demand.

Marc Hodak said,

Anon – While the link was to a Nasdaq site, the definition of “double auction” is a generic one for both Nasdaq and NYSE (as well as most other real-time securities or commodities markets). Whether you are using market makers or dealers, the overwhelming number of trades involves matching bid and ask spreads where they overlap. The only time NYSE market makers exercise any of the kind of judgment that might be characterized as “price negotiation” is at the opening and closing or in moments of unusual volatility. Even then, they must rely on sellers willing to drop their price enough to attract the most aggressive buyers, or buyers willing to up their price to the most reticent sellers, i.e., managing an auction from both directions.

Add A Comment