Posted by Marc Hodak on June 29, 2009 under Scandal |

Nathan Hale, a hero of the American Revolution, condemned by the British to hang as a spy in 1776, famously said that he regretted that he had “but one life to give for my country.”

Madoff’s victims, many of whom have been condemned to a life of unexpected financial struggle, probably regret that the old devil had no more than one life to give for his crimes based on his 150 year sentence.

Is there a lesson from the Madoff debacle? I don’t know. His crime was a catastrophe for everyone who trusted him, and on a larger scale than anything before perpetrated by a private individual. Several ethical codes suggest a moral:

– Common sense: Don’t put all your eggs in one basket

– Western religion: If you do put all your eggs in one basket, make certain you know what that basket is made of

– Eastern religion: Better not to have many eggs; all baskets eventually fail

I don’t know if any of these are particularly helpful, but two morals–the ones most often cited in the press–are quite unhelpful:

– Fundamentalist: Greed is evil, and must be brought under control

– Political: The government needs more money and more power to prevent these things

The fundamentalist hypocrisy is that only certain other people are greedy. It appeals to the vanity that you or I would never succumb to the sin of wanting more than we have, much more if given the opportunity. In fact, greed was on both sides of the Madoff equation. The victims experienced a certain feeling every time they opened one of the fake statements telling them how much they “made.” That feeling was indistinguishable from greed, and it was indispensable to perpetuating the Madoff scheme. Nevertheless, I would never say that the victims deserved what happened to them.

Madoff’s real sin was, in fact, theft. Among the multitudes infected by the sin of greed, I believe that most of us are morally equipped to avoid perpetrating theft.

The government’s prescription, of course, is a joke. Madoff was registered with the SEC. They were furnished specific concerns about his legitimacy. The clean bill of health given by the regulators simply helped Madoff reel in more victims.

Posted by Marc Hodak on June 26, 2009 under Uncategorized |

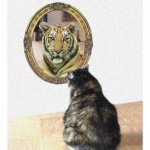

Hannah was a big, fluffy manx. She hated that. She hated that her appearance invited cuddling, as if she were some kind of plush doll. How demeaning.

“Don’t these humans understand? I’m a vicious beast. I have claws! And fangs! I could have them all for a snack, like that.”

Actually, Hannah didn’t have front claws, but she would sharpen them anyway against a door post or cardboard box when she saw me coming.

Hannah put up with us gamely. She would walk up to Tess and meow, and Tess would say, “Hi sweetie pie! Do you want hugs and kisses?” Hannah would furrow her furry brow as if to say, “How clueless are you, human? I’m shedding and I need brushing. Don’t pick me up…no…”

Hannah came in a package deal with Tess. For the first ten of her fifteen years, it was just the two girls. They were inseparable. Tess took Hannah on business trips; the kitty would greet her when she got back to her room. Tess thought Hannah was the most beautiful, intelligent, loving creature in the world. Hannah saw Tess as beautiful and loving, as well, but a little dense. Hannah would tell her what she wanted…food, brushing, scratching, etc… and Tess would ask, “What is it, sweetheart? Do you want hugs and kisses?” You could see Hannah’s reaction: “Oh, what a dear idiot.” She would then repeat her request more slowly, so her dopey mom could understand.

Of all the dim things her mom ever did, though, bringing me into their lives was the most inexplicable. “Don’t you understand, anything?” Hannah tried to warn her. “This big, ugly, stupid, hairless ape will ruin everything!” Hannah complained about me often. When Tess would return home, Hannah was always at the door to greet her, and tell her how I had tormented her with attention, or threats of attention, which for her was always unwanted, except for the chin scratching, and a little around the ear, when she indulged me.

Even worse, the Man that Tess latched onto had two boys, which besides all that unwanted attention meant a total of six big feet, lumbering around like a clueless field of swinging mallets. Since she normally operated in stealth mode to avoid petting, we did occasionally kick or step on her by accident. Her mom did the same thing, but Hannah assumed, as when any misfortune befell her, that is was somehow my fault.

Hannah met her end, as is common in old cats, with kidney failure. We treated her for months with hydration and medication which, from her vantage point was simply daily poking and having putrid liquids shoved down her throat. (Again, I was clearly to blame, even though her mom was often holding her.) On the second round of treatments for an infection, she finally said, “Enough.”

Hannah will be shipped to back to the farm in Missouri where she was born so her grandmother can bury her next to the family’s other favorite companions, Nick and Shorty.

I already miss the ornery little fluffball.

Posted by Marc Hodak on June 19, 2009 under Invisible trade-offs, Politics |

I picked up today’s Wall Street Journal this morning and saw a picture of two old Latvians literally at each others’ throats. The story behind that pic is that Latvia has promised pensions and public sector jobs to many, many people. Now that it can’t fund that promise (which was likely predictable at the time the promises were made), and is proposing to cut back 10 percent on pensions and 20 percent on public sector wages. My guess is that one of the people in the picture is a pensioner, and the other is a public sector employee, or spouse of one. My certainty is that they are frustrated by the perceived betrayal of their government, the reality that the losses are not going to hit everyone evenly, the reality that political influence will determine who gets what, and that they don’t have any. So they do what people often do in that situation–they turn on each other. Whenever the government must choose among the recipients of its largess, especially as it withdraws it, it is bound to create social strife.

You also see an echo of that in the headline story “Corporate Lenders Get Hit,” which describes how proposed rules for lending won’t hit all lenders evenly, and may even drive certain types of lenders out of the market. In this case, the disfavored lenders are figuratively hitting back via their lobbyists.

If one takes political debates on economic issues at face value, one can be forgiven for thinking that trade-offs are never necessary. Each side argues from an “all we need…” advocacy. When they admit of any conflicts their scheme may create, they invariably assert that sensible bureaucrats can make sensible trade-offs against fair standards, never admitting that fairness is impossible when the standards are arbitrary, and that nearly every standard creates, at its contentious, man-made boundary, winners and losers, often in the millions.

But when tough choices need to be made, as they always will be with the imposition of man-made rules, we are also apparently amused by pictures of people at each other’s throats, as long as it’s not us in those pictures.

Posted by Marc Hodak on June 15, 2009 under Executive compensation, Invisible trade-offs, Politics, Unintended consequences |

The government, purveyor and practitioner of the most perverse incentives on the planet, is coming down the road with a cart of new remedies for incentive compensation:

“This financial crisis had many significant causes, but executive compensation practices were a contributing factor,” Geithner said in his statement on Wednesday. “Incentives for short-term gains overwhelmed the checks and balances meant to mitigate against the risk of excess leverage.”

It is, indeed difficult to pinpoint all the potential causes of the financial crisis, and it’s certainly plausible to point the finger at bank compensation. The politicians and media would have us believe that:

A consensus has grown in Washington that compensation incentives based on short-term profit encouraged excessive risk taking at banks and played a major role in creating the financial crisis.

But the manner and degree to which bank compensation is at fault is, in fact, quite speculative. Read more of this article »

Posted by Marc Hodak on June 14, 2009 under Practical definitions |

The WSJ headline is: “Southern States Poach Business Amid Downturn”

Kind of conjures up some southern hick with a shotgun sneaking up on someone’s farm, and leading away some cattle in the dead of night.

It doesn’t seem to conjure up decades of rustbelt politicians sucking the life out of their businesses with ever-increasing taxes, and workplace regulations flowing from their capitals like topsy. It doesn’t evoke geographic and jurisdictional competition, with entrepreneurs and corporate managers coolly poring over spreadsheets deciding where to invest their scarce capital.

Would a southern newspaper use the word “poach” to describe competition for capital in this context? I don’t think so. It used to be that you could expect such anti-business wordsmithing from the New York Times. But we see just as well on the front page of the Wall Street Journal.

Posted by Marc Hodak on under Executive compensation, Reporting on pay |

Apparently, the answer is: just because the Corporate Library said so.

In a recent report called “What is the Impact of PE on Corporate Governance,” the corporate library concluded that their analysis:

…does not support the private equity claim to superior corporate governance as the companies enter the public markets. On the contrary, it indicates that buyout-fund-backed companies exhibit, in higher proportion than average, a number of features that have the potential to benefit executives at the expense of shareholders, including takeover defenses and boards whose independence may be compromised. In addition, the often-made assertion that private equity firms design compensation packages well suited to link pay to performance is not supported by this study. The companies lacked the key compensation structures that are widely believed to link pay to performance.

As someone who designs compensation packages for PE firms, and has often asserted that the designs were especially well suited to link pay for performance, I was interested in the basis for their conclusions. What key compensation structures were PE-backed firms lacking? Who are all those people who believed in them?

The report ended up offering a hopelessly muddled approach to compensation unsupported by any empirical analysis.

Read more of this article »

Posted by Marc Hodak on under Economics, Politics |

Compare this item of health care reform being proposed by the Administration:

“The president does not want to dismantle privately owned plans. He doesn’t want the 180 million people who have employer coverage to lose that coverage. He wants to strengthen the marketplace,” Sebelius added.

with this:

President Obama, in a pivot from some of his harshest campaign rhetoric, told Democratic senators yesterday that he is willing to consider taxing employer-sponsored health benefits to help pay for a broad expansion of coverage.

Versus this more recent pronouncement of Obama’s second:

Vice President Joe Biden opposed proposals being discussed by some lawmakers to tax health insurance benefits provided to people by employers as a way to pay for an overhaul of the $2.5 trillion U.S. healthcare industry.

Which indicates that Obama is waffling either on his committment to not tax these benefits, or to consider taxing them, or that Biden hasn’t gotten the most recent memo. History shows that all three are possible, even at once, in terms of political positions. As economic propositions, though, the government will have to make a trade-off: reduce private health care by taxing it, or paying for public health care by raising the money elsewhere. Reality, unlike politics, won’t allow you to have it both ways, let alone all three.

Posted by Marc Hodak on June 9, 2009 under Executive compensation, Invisible trade-offs, Reporting on pay |

So, you’ve played the populist card on executive compensation, Mr. President. You used it to provide cover for the mammoth, Democratic-payback-mondo-porkfest called the “Stimulus Package.” You used $500K to buy $787B. Well played, sir. But now that card is on the table. You can’t just pick it up again.

So, now we all have a bunch of silly-assed compensation rules that anyone could have predicted would create retention risk at American public banks. Sure, most people were saying, “Screw ’em. Where else could they go?” but we knew otherwise, didn’t we BO? We knew that any bank under TARP would chafe at the pay restrictions, in part because it put them at a competitive disadvantage. We knew that once you set some of the banks free, they would poach the others into submission, those big wounded banks still trapped under TARP, with all that taxpayer investment. Poof.

So here we are, on the eve of a TARP repayment by some banks that you have done everything to slow. But that part of the game is finally up. Now, what do you do?

Of course. You try to maintain some uniformity on the pay restrictions across all the banks, in and out of TARP. So, you’re forced to loosen up some of the restrictions on the remaining TARP banks while imposing new ones on the soon-to-be non-TARP banks. I know where you’re coming from, Mr. President.

Don’t worry, your secret appears safe, for now. The media has not a clue about your strategy or its motivation. Most of them are still at the “where else can they go?” stage. And the regular readers of this blog are plenty smart enough, but there’s only a few dozen of them–not enough to really alert the media. So, don’t worry. Do what you have to do. It’s all you can do, isn’t it Mr. President, as political choices lead to economic consequences that prompt more political choices…

Posted by Marc Hodak on under Collectivist instinct, Politics |

The formula accepted by every political leader: Max(societal good) = MM+MP. Here are the terms:

MM = More money

MP = More power

Every government official will tell you, there is no problem they can’t solve if only you grant them MM+MP. As long-time readers know, I have come to facetiously label this formula Hodak’s Law, since it is so commonly, universally invoked by politicians, and credulously reported by the press. Tim Geither is clearly no exception.