Separate Financing from Operations

This is what we need (operating decision):

This is how we acquire it (financing decision):

Example - Borrowing to build a factory

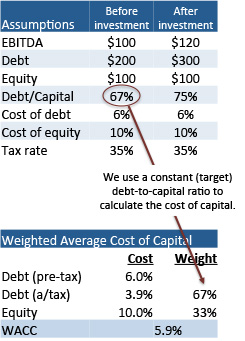

We decide to build a $100,000 factory and to borrow the money for the purchase (figures in 000s):

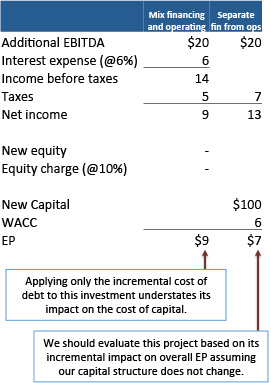

In Baseline EP we applied a weighted average cost of debt and equity to the total capital base. If we only use the cost of incremental capital (e.g., debt in this example) to evaluate any given investment, we are likely to misstate its impact on overall EP.

In order to properly evaluate the impact of an investment on EP, we should evaluate it on the basis of the same weighted average cost of capital that applies to the underlying business, unless the investment itself results in a material change in our target capital structure. If our intent is to change our capital structure, the impact of that change should be still assessed independently of any particular investment decision.