Better Matching

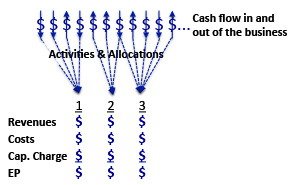

GAAP accounting is a set of rules for categorizes cash flows and allocating them to specific accounts and periods. The rules are designed mainly to accrue revenue in the period in which revenue generating activities occur, then allocate costs required to support those revenues to those same periods, i.e., match revenues and costs. But conservatism sometimes requires the deferral of revenues or acceleration of expenses, which can create a mis-match that distorts profitability from one period to the next.

We can adjust Baseline EP derived from the accounting to create a better matching of revenues and expenses to that makes profit more meaningful each period.

Example - Restructuring

Our business needs to reorganize to meet changing demands. This will require closing down certain facilities and laying off people. The total charge will be $100 million, which will be spent on relocation and severance costs over the next two years. We will begin to realize the benefits of lower operating costs and other efficiencies over that two year period.

Gradual improvements take place, but profits swing wildly

Expenses are going up with revenue until the restructuring begins to take place. Over two years, expenses are reduced until they settle at the new, lower level after the restructuring is complete by Year 2.

Summary result with Baseline EP versus adjusted EP

Baseline EP drops severely in the year of the restructuring charge, then rebounds sharply in the following year. In other words, the year in which the charge is taken (Year 0) looks awful. The year in which the non-recurring charge does not recur (Year 1) looks awesome.

Change in EP (EVA) is supposed to track changes in value. Here, Baseline EP is buffeted by accounting charges.

By capitalizing the restructuring charge, change in EP (EVA) accurately reflects improving results over the time frame that those improvements occur.