The Last Refuge of Scoundrels

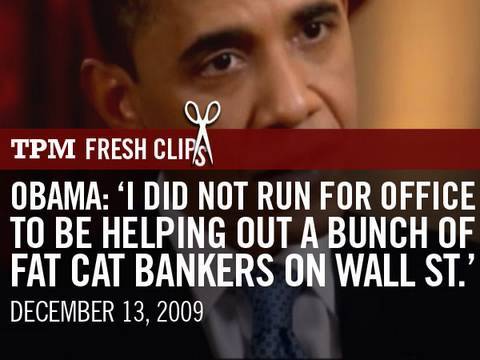

It used to be said that patriotism was the last refuge of scoundrels. Now that patriotism is being viewed with more irony than honor among a certain portion of Americans, I think the “last refuge” has become the bashing of “fat cats.” My evidence is a recent spate of articles on how President Obama, who is polling rather poorly these days, is once again going after Wall Street bonuses. There is no surer way to get heads nodding again when you speak.

I nod, too, but for a different reason. I continue to be astounded by the idea that banks had been managing the well-understood “trader’s option” problem for decades, then suddenly lost the ability to do so in the mid-2000s, and crash goes the financial system. This explanation simply doesn’t hold water. Neither does the idea that bankers suddenly became “greedy” in the mid-2000s, and crash went the financial system. No. If one wishes to develop a cogent theory about “what went wrong,” one must identify distinguishing characteristics, not common, long-imbedded ones.

I can (and have) provided many reasons why the “bonus culture” of banks has been unfairly blamed for the financial crisis. Fahlenbrach and Stulz (http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1439859) provided the best empirical evidence that it didn’t.

Now, a new paper by legal scholars Whitehead and Sepe basically blames competition for talent as undermining proper incentives. I salute them for at least acknowledging the competition for talent in banking. Most critics of the banking system were feverishly trying to outdo each other in how firmly they would cap banker pay in arbitrary ways at arbitrary levels without regard to the competitive issues that such rules would create in order to “solve the problem” that they claimed was at the heart of the financial crisis. The ensuing exodus of talent at large, public U.S. banks has been unbelievable. (Literally–people outside of the industry don’t believe me when I tell them how bad it has been. The more polemical critics simply roll their eyes and smugly say, “Yeah, the talent to blow up the economy. Good riddance.”) Whitehead and Sepe acknowledge the competitiveness issue, but then go on to recommend arbitrary limits on how bankers may move from one firm to another.

If you believe that you have to compete for talent in financial services, including traders, and if you understand that different forms of pay offer different expected value to potential employees, then one can readily see that the only way to increase the risk and constraints of banker pay while acknowledging the need to compete for their talents would be to increase the expected value of that constrained, riskier pay package. Partnerships do this all the time. They create very risky, very constrained pay packages, and manage to lure incredible talent. Hedge funds didn’t contribute to the financial crisis, and didn’t need to get bailed out. And no one is suggesting that we need to limit how hedge fund employees move from one firm to another in order to moderate or contain risky behavior. What makes this work is that hedge funds don’t have to disclose how much their successful people earn.

How little President Obama and his staff know about these issues may or may not shock you. But he doesn’t have to know anything about the economics and dynamics of incentive compensation in the financial sector, or any sector. He just has to know the math: “Bashing Wall Street” = “Higher poll numbers.”

Add A Comment